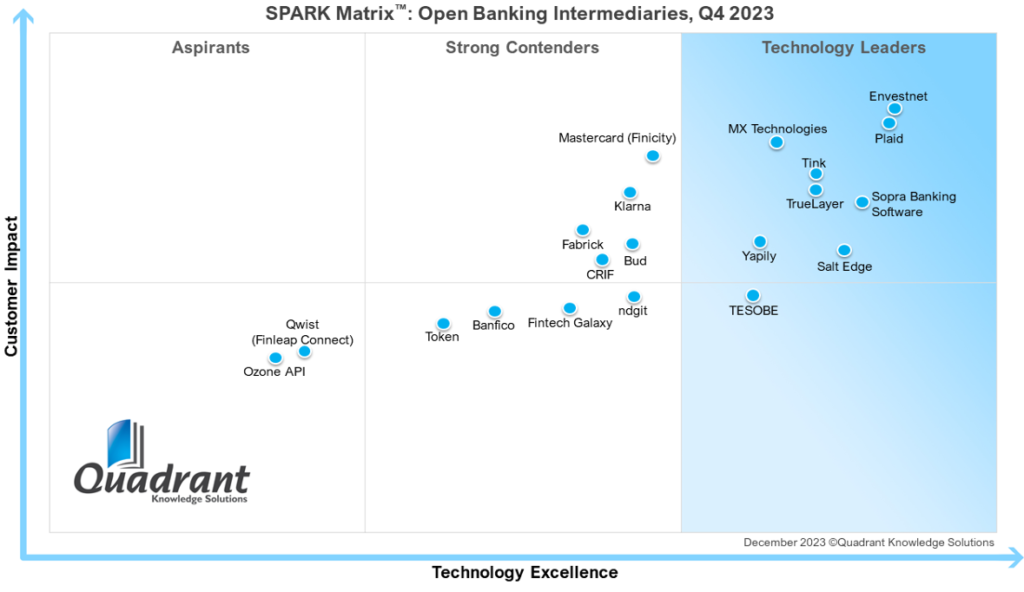

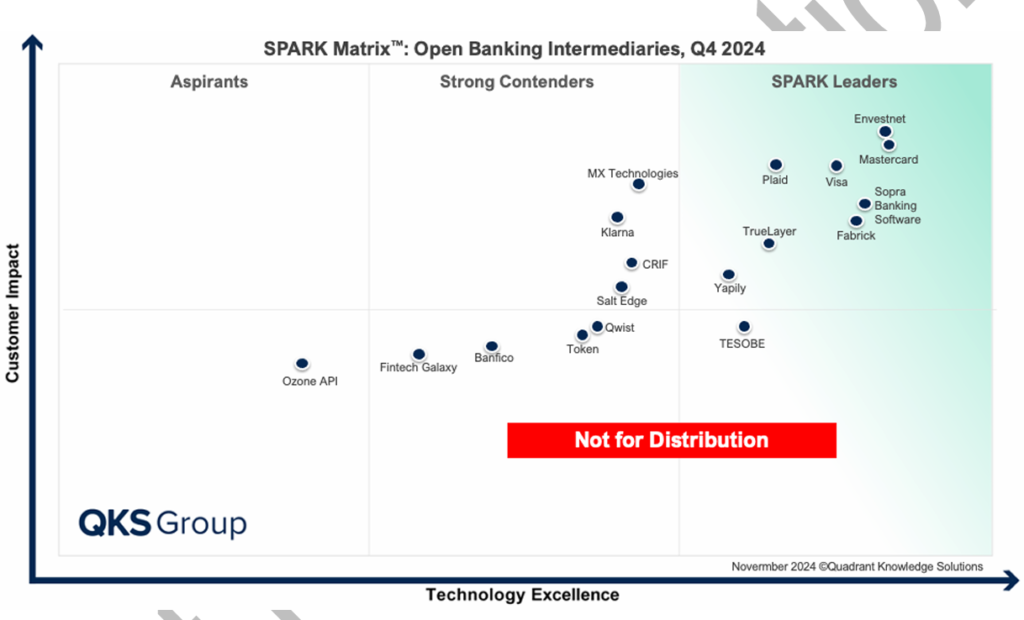

The open banking intermediaries market has shifted from data aggregation utilities to full-scale orchestration engines. Between 2023 and 2024, leadership was redefined by vendors that embedded payments, broadened interoperability, and accelerated time-to-value through orchestration and AI-driven enrichment.

In 2023, leaders were defined by aggregation depth, regulatory readiness, and multi-use-case support. By 2024, the criteria shifted toward operational AI, payments initiation with variable recurring payments, orchestration across ecosystems, and end-to-end compliance readiness. Vendors that added value-added services and improved developer ecosystems climbed; those reliant on traditional aggregation fell behind.

What the SPARK Matrix Measures

The SPARK Matrix benchmarks vendors across:

- Technology Excellence

- Customer Impact.

Technology covers aggregation, enrichment, payments, consent, fraud detection, interoperability, and roadmap vision. Customer Impact spans strategy, presence, record of deployments, ease of deployment, service excellence, and differentiated value. This two-axis evaluation reveals which vendors deliver both robust capabilities and measurable business outcomes.

Top Trends in 2024

1. Payments became the growth engine

In 2023, most intermediaries were still measured on account aggregation and insights. By 2024, payments initiation, including VRPs and success scoring, emerged as the key differentiator. Visa and Mastercard converted their networks into real-time rails, using orchestration to improve settlement predictability. TrueLayer extended merchant-focused payment links, while Yapily prioritized integration with digital commerce. Vendors lacking credible payments capability, such as niche aggregators, lost relative positioning.

2. AI and risk engines matured into decision tools.

Risk scoring accuracy became central to leadership. Plaid, leveraging Cognito, expanded into identity and KYC checks, reducing onboarding friction. CRIF and Salt Edge pushed ML-driven enrichment, lowering fraud while improving affordability insights. This separated operationally mature vendors from those with static, rule-based checks.

3. Orchestration defined time-to-value.

Large institutions demanded composability, linking APIs, ERPs, and PSPs without custom coding. Sopra Banking Software gained ground by offering ecosystem orchestration layered on compliance and connectivity. Fabrick emphasized platform-as-a-service models that brought fintechs and banks into shared ecosystems. By contrast, vendors with isolated aggregation stacks stalled.

4. Ecosystem and geography drove differentiation.

European compliance origins gave vendors like TESOBE and Salt Edge credibility, but scaling globally required partner ecosystems. Envestnet and MX Technologies benefited from U.S. fintech adoption, while Fintech Galaxy and Banfico sought Middle East differentiation. Geographic fit influenced quadrant shifts as much as technology.

5. Ease of deployment determined customer impact.

Institutions now demand faster deployment with lower maintenance. Vendors with strong developer portals, prebuilt connectors, and modular white-label options, such as Token and Qwist, improved positioning. Complex, heavy-integration vendors saw limited momentum.

Vendor Position Analysis

Leaders: stability with payment-first differentiation.

Visa, Mastercard, Envestnet, Plaid, TrueLayer, Yapily, Fabrick, Sopra Banking Software, and TESOBE retained or gained leader status. Their common thread was expansion beyond aggregation into payments and orchestration. Visa and Mastercard leveraged global scale and compliance; their challenge remains adapting to regional regulatory nuance. Plaid grew via Cognito but must prove scale in non-U.S. markets. Envestnet continued to build on Yodlee but faces integration complexity in legacy deployments. TrueLayer’s payments-first pivot improved merchant impact, though its dependency on Europe could limit diversification. Yapily’s strong payments focus helped it climb, but scalability in fraud detection remains a gap. Sopra Banking Software moved deeper into orchestration, though balancing compliance upgrades for PSD3 with innovation is its near-term challenge. TESOBE, with its open-source ethos, gained credibility but must overcome institutional reluctance to adopt open models. Fabrick benefited from ecosystem positioning but faces margin pressure as embedded finance commoditizes.

Contenders: robust technology, mixed adoption.

MX Technologies, Klarna, CRIF, Salt Edge, Qwist, Token, Banfico, and Fintech Galaxy were grouped as Strong Contenders in 2024. MX’s API-first suite aligns with FDX standards, yet global reach lags. Klarna leveraged consumer data for risk and payments but needs to demonstrate enterprise scalability. CRIF excels in risk and credit analytics, but struggles with broad ecosystem integration. Salt Edge is compliance-rich and strong in Europe, but less visible in APAC. Token expanded payment initiation but needs stronger developer engagement. Qwist (ex-Finleap) repositioned through partnerships but has limited differentiation. Banfico and Fintech Galaxy built regional ecosystems but remain niche outside their home geographies.

Aspirants: narrow scope, innovation pressure.

Ozone API stood alone as an aspirant in 2024. Its open banking standard alignment is respected, but limited payments and orchestration keep it niche. Without broader partnerships, its quadrant movement will remain constrained.

Exits: Tink and Bud.

Notably, Tink, acquired by Visa in 2022, was consolidated into Visa’s open banking proposition, removing its standalone placement by 2024. Bud, once positioned as a data-focused challenger, was absent in 2024, reflecting consolidation pressures and limited adoption outside the UK. Their exit highlights how consolidation reshapes the map.

What should be taken into consideration?

For buyers, leadership is no longer defined by aggregation breadth alone. The real differentiator lies in operational AI, orchestration, and payment-first capabilities that reduce friction, improve conversion, and shorten time-to-value. Buyers should prioritize vendors that combine PSD2/PSD3 compliance with future-ready orchestration, strong developer ecosystems, and AI-driven enrichment.

For vendors, the mandate is clear: payment orchestration is now table stakes, and composability must extend beyond banking APIs into ERP, eCommerce, and risk systems. Building regional partnerships and modular ecosystems will be as important as technology maturity in sustaining quadrant leadership.

According to Pradnya Gugale, Principal Analyst at QKS Group,

“Open Banking Intermediaries play a pivotal role in bridging financial institutions, third-party providers, and end-users by facilitating seamless and secure access to banking data through APIs, enabling the creation of innovative financial solutions, such as personalized lending, real-time payment processing, and advanced financial management tools. Modern open banking intermediaries leverage technologies like AI, ML, and data encryption to ensure compliance with regulatory frameworks, enhance data security, and deliver frictionless user experiences. By providing connectivity across diverse banking systems, they empower fintechs, SMBs, and enterprises to innovate, drive customer engagement, and unlock new revenue streams in the rapidly evolving financial ecosystem.”

Conclusion

The 2024 SPARK Matrix for open banking intermediaries redefines leadership around orchestration, AI, and payments. Vendors that scaled beyond aggregation into payment-first, ecosystem-ready platforms advanced; those that remained narrow lost ground. Leadership now means owning the transaction journey end-to-end while delivering measurable time-to-value.