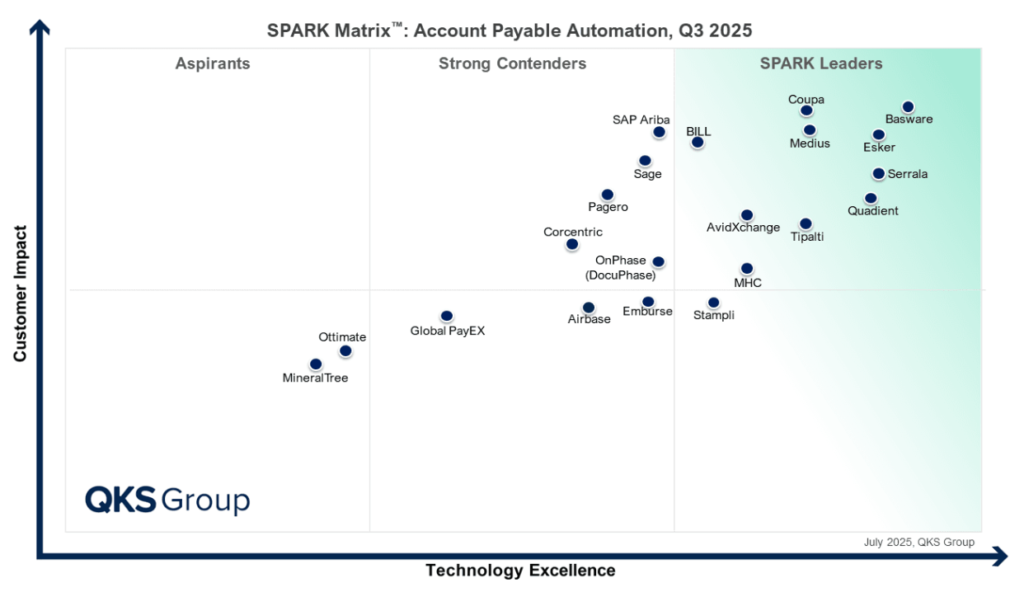

The Accounts Payable Automation (APA) market has moved decisively from digitization to intelligent orchestration. The 2025 SPARK Matrix™ shows that leadership is now determined by operational AI, compliance resilience, and embedded payment orchestration. Vendors that matured their AI-driven touchless processing and regulatory capabilities advanced strongly, while others lost ground due to weak adoption, limited regional scope, or dependency on legacy workflows.

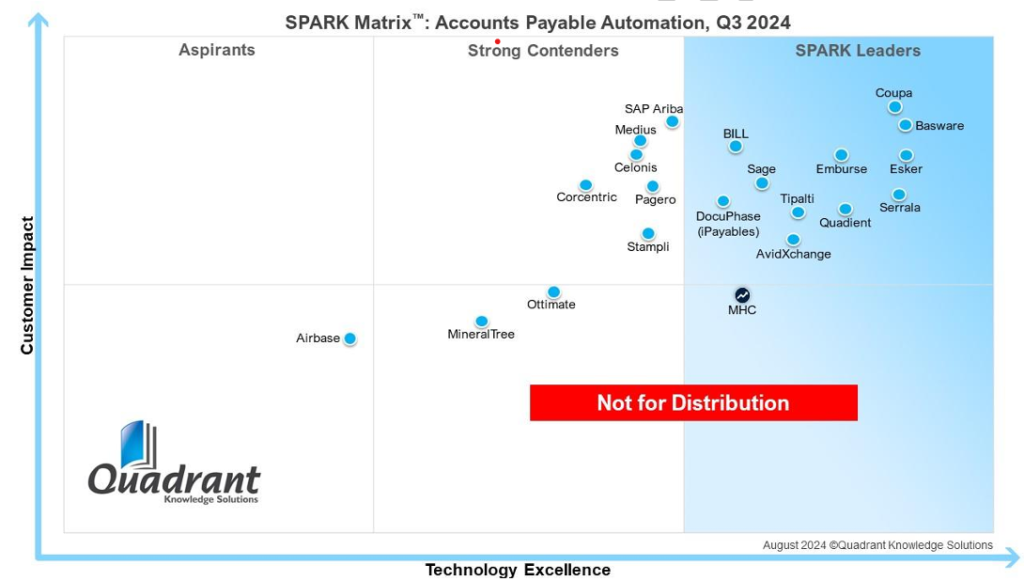

The year-on-year shifts are striking. Medius climbed from contender to leader by integrating payments at scale. MHC rose from emerging leader to strong leader with its configurable, AI-powered workflows. Stampli ascended into the leader zone by proving its AI assistant “Billy the Bot” can scale adoption. Conversely, Sage, Emburse, and DocuPhase (now OnPhase) slipped to contenders due to slower innovation and integration gaps. New entrant GlobalPayEX added fresh competition, while Ottimate and MineralTree fell into the aspirant zone, highlighting the market’s rising performance bar.

What the SPARK Matrix Measures

The SPARK Matrix™ benchmarks vendors across

- Technology Excellence

- Customer Impact

In 2025, heavier emphasis was placed on AI maturity, compliance orchestration, embedded payments, and ecosystem time-to-value, shifting vendor positions significantly.

Top Trends in 2025

1. AI-driven automation reshaped competitive dynamics

Vendors that deployed operational AI for anomaly detection, predictive coding, and fraud prevention moved upward. Medius embedded real-time fraud detection and payment analytics into MediusPay, boosting its rank. Esker and Basware improved predictive matching and compliance automation, retaining leadership. However, vendors like Sage lagged in GenAI adoption, explaining their drop to contender status.

2. Compliance orchestration became a non-negotiable

Global e-invoicing mandates forced vendors to expand interoperability. Tipalti advanced with cross-border payment compliance and proactive fraud monitoring. Pagero gained contender strength by offering comprehensive invoice validation across Europe. By contrast, OnPhase (formerly DocuPhase) fell because it lacked the same regulatory breadth, despite strong usability.

3. Embedded payments turned AP into a liquidity engine

Platforms like BILL and Medius climbed by uniting AP automation with payments, offering cashback, early discounting, and virtual card options. AvidXchange sustained leadership through its strong middle-market payment network. Yet, payment-linked revenue models expose vendors to margin compression from transaction fees.

4. Composable integration defined time-to-value

Coupa, Esker, and Quadient held strong leader positions with multi-ERP support and modular deployments, appealing to enterprises facing M&A-driven complexity. Meanwhile, Emburse fell to contender as its product breadth outpaced its ability to maintain integration simplicity across global clients.

5. New entrants and exits reshaped the lower quadrants

Airbase rose from aspirant to contender by scaling adoption among mid-market finance teams with strong UI and spend-control alignment. In contrast, Ottimate and MineralTree slipped to aspirants, unable to keep pace with compliance-heavy and AI-first innovation cycles.

Vendor Position Analysis

Leaders

Coupa remains a leader by scaling Spend Guard and e-invoicing compliance, although ERP rollout complexity continues to be a challenge. Basware defended its leadership with GenAI-led invoice processing and benchmarking but must now drive adoption outside EMEA. Esker retained strength with predictive AI, supplier risk insights, and strong European compliance, though balancing its S2P breadth is a risk. Medius rose to leadership through embedded payments and analytics. Its new rank reflects success in orchestrating AP and liquidity, though global scalability is still developing. BILL advanced further by monetizing card-based payments for SMBs but lacks enterprise reach. Serrala secured leadership with GenAI workflows and SAP-embedded options yet remains regionally weighted toward Europe. Quadient held leadership with multi-entity visibility and Hub-driven orchestration, though innovation pace trails cloud-native rivals. Tipalti sustained leadership through fraud prevention and global payment orchestration, but margin pressure looms. AvidXchange retained leader status by deepening middle-market payment integrations, though global expansion is limited. MHC climbed from emerging leader to strong leader by expanding GenAI-assisted workflows and NorthStar’s configurable design. Its challenge lies in scaling beyond North America. Stampli rose to emerging leader status by scaling Billy the Bot beyond SMBs. Its risk is proving enterprise-grade resilience.

Contenders

SAP Ariba regained ground with Taulia-powered discounting and compliance orchestration, but UX modernization remains slow. Sage slipped from leader to contender due to lagging AI maturity and limited innovation cadence. Pagero strengthened with European compliance orchestration, though its payments innovation trails leaders. Corcentric improved via StopFraud Validation but faces margin strain scaling its managed services. OnPhase (formerly DocuPhase) fell from leader to contender due to limited regulatory interoperability despite usability strengths. Emburse dropped from leader to contender as its breadth strained global integration simplicity. Airbase rose from aspirant to contender by proving its spend-first AP automation scales, though enterprise traction is early. GlobalPayEX, a new entrant, entered as a contender by delivering B2B payments and invoice reconciliation in India and APAC. It must globalize to climb further.

Aspirants

Ottimate fell from contender to aspirant as innovation slowed, limiting regulatory and AI advancement. MineralTree also slipped, unable to match compliance or orchestration demands despite SMB adoption strength.

What Should Be Taken into Consideration?

Enterprises should prioritize platforms that combine AI-driven invoice intelligence, compliance orchestration, and embedded payments within a composable architecture. Vendors demonstrating rapid regulatory alignment and multi-ERP integration will deliver the shortest time-to-value.

Sustaining leadership requires moving beyond digitization toward operational AI, global compliance orchestration, and embedded liquidity management. Ecosystem partnerships, regional mandates, and modular deployments are the decisive levers of competitive advantage.

According to Hetansh Shah, Analyst at QKS Group, “Accounts Payable Automation (APA) solutions are critical financial tools that empower organizations to optimize invoice processing, streamline payment workflows, and enhance cash flow management. Leveraging AI-driven automation, real-time analytics, and seamless integrations with ERP systems, modern APA platforms reduce manual errors, accelerate payment cycles, and ensure compliance with evolving financial regulations. With features like predictive cash flow forecasting, dynamic discounting, and cloud-based scalability, APA solutions are enabling businesses to improve operational efficiency, strengthen supplier relationships, and adapt to the demands of a digital-first economy.”

Conclusion

In 2025, Accounts Payable Automation leadership is defined by intelligence, compliance, and orchestration at scale. Vendors that prove operational AI while embedding payments and regulatory alignment are not only digitizing AP but transforming it into a strategic lever for liquidity and resilience.

To understand and know more about the APA 2024 Report analysis, you can refer to the APA and Smart Payments Transforming Fintech.

Access the report to know more: SPARK Matrix™: Accounts Payable Automation, Q3 2025