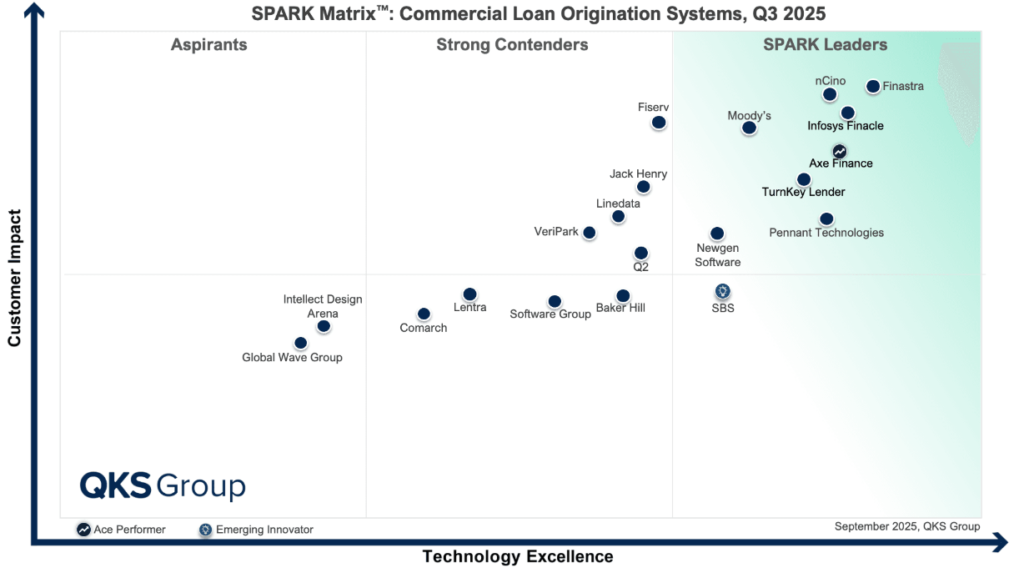

The commercial lending technology landscape has shifted dramatically between 2024 and 2025. What was once a modest evolution is now a full-scale transformation, driven by the urgent demand for automation, real-time credit intelligence, and embedded finance capabilities. The 2025 SPARK Matrix™ continues to highlight these tectonic changes, reflecting how banks and non-bank lenders are re-evaluating their architecture to stay competitive.

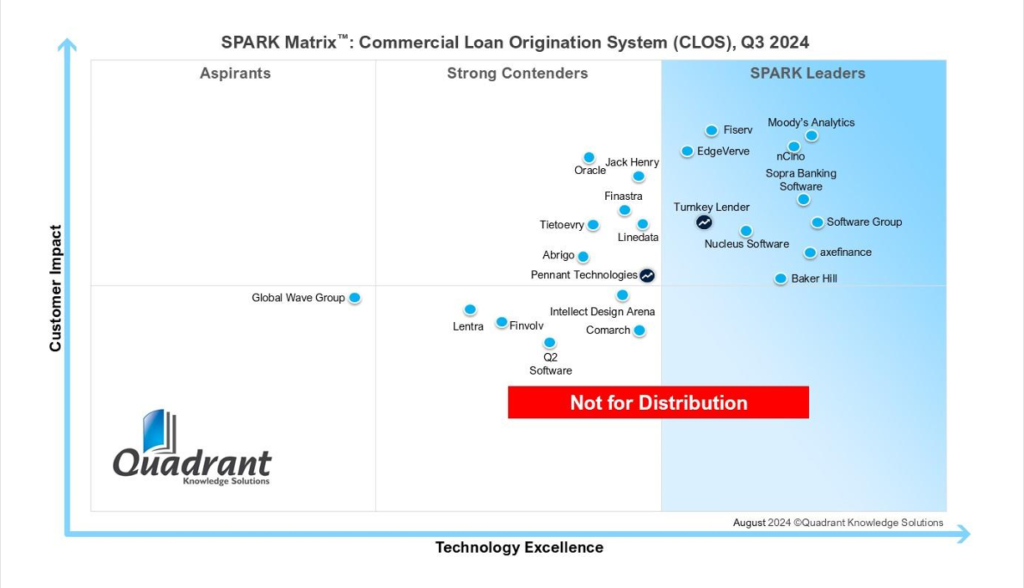

In comparing the 2024 and 2025 vendor sets, not only do we see clear winners and losers, but also a wave of fresh players, some surprising departures, and a reordering of priorities. Below, we break down who’s rising, who’s holding steady, who’s slipping, and who’s new to the race.

According to Akhilesh Vundavalli, Principal Analyst at QKS Group, “Retail Core Banking Systems across EMEA and APAC are entering a transformative phase where agility, intelligence, and compliance must coexist by design. Banks in both regions are accelerating their move toward cloud-native, API-first core architectures that can handle real-time payments, multi-rail processing, and high-volume digital engagement. While EMEA’s modernization is shaped by stringent regulatory frameworks, open finance mandates, and rising cybersecurity demands, APAC’s momentum is fueled by digital-native consumers, hyper-scale transaction environments, and fierce competition from fintechs and super-app ecosystems. As institutions navigate diverse regulatory landscapes, heightened fraud risks, and evolving customer expectations, the next generation of retail core platforms will be defined by adaptive compliance, predictive intelligence, and the ability to deliver frictionless, context-aware experiences at scale across both mature and high-growth markets.”

Who’s Evolving (The Movers & Shakers)

The New Leaders

The 2025 matrix didn’t just shuffle existing players; some platforms leapfrogged the competition to secure top-tier Leader positions.

Finastra rose from a 2024 Contender to a 2025 Leader. Their leap reflects a decisive shift toward AI-powered credit workflows, real-time pricing intelligence, and a modular architecture that supports corporate and SME lending alike. On a Global scale, with robust corporate/SME lending coverage, an API-first platform enabling ecosystem integrations.

Infosys Finacle made a striking debut, entering the SPARK Matrix for the first time and landing directly in the Leader quadrant. Its modern, cloud-native core and modular origination stack are clearly resonating in 2025’s market, a testament to how rapidly expectations have evolved. Strengths: Comprehensive digital lending lifecycle support (onboarding through servicing); strong presence in global markets.

Axe Finance held on to its Leader status thanks to continuous enhancements: advanced covenant monitoring, integrated collateral workflows, and an AI-native risk engine, increasingly critical differentiators in today’s volatile credit environment. Strengths: Sophisticated AI-driven risk and covenant capabilities; broad exposure across EMEA corporate lending markets.

TurnKey Lender remains a stable Leader, its unified cloud-native stack proving resilient and relevant. Its emphasis on speed-to-market, configurability, and borrower experience keeps it competitive. Strengths: Cloud-first architecture and rapid deployment; intuitive, borrower-friendly workflows.

nCino continues to deliver consistent value. Its cloud-native, Salesforce-based architecture remains one of the most mature and widely adopted corporate lending platforms, especially for institutions seeking seamless workflow automation. Strengths: Deep commercial lending workflow automation; strong ecosystem integrations and scalability.

Moody’s Analytics maintained its leadership by doubling down on risk intelligence. Enhanced financial modeling, improved covenant evaluation, and real-time risk scoring helped it preserve its spot among the top-tier platforms. Strengths: Market-leading credit risk analytics and covenant management; robust data capabilities for risk-informed decision-making.

Pennant Technologies made one of the boldest moves: from 2024 Contender to 2025 Leader. Scoring well on both technology excellence and customer impact, Pennant’s AI-powered underwriting engine and real-time pricing innovations are clearly paying off. Strengths: Agentic AI underwriting and pricing engine; strong support for corporate and SME credit workflows.

Who’s Stalling (Static or Dropping)

Not all vendors are advanced. Some held their ground, others slipped, signaling either slower innovation cycles, limited reinvestment, or strategic misalignment with the accelerating market demands.

Fiserv dropped from Leader to Contender. Although it still boasts a strong omnichannel framework for credit workflows, it appears to be outpaced by newer, more agile, API-first platforms. Strengths: Robust omnichannel lending framework; stable workflow automation. Software Group moved down from Leader to Contender, suggesting their modernization pace has not kept up with cloud-native and AI-native peers. Their strength lies more in legacy banking markets than in cutting-edge commercial lending. Strengths: Experienced in emerging markets; versatile lending modules for traditional banking setups.

Baker Hill also shifted from Leader to Contender. Their U.S.-focused credit and approval workflows remain solid, but the relative lack of AI-driven enhancements likely contributed to the demotion. Strengths: Strong financial spreading and credit analysis engine; dependable approval pipeline automation. Nucleus Software remains a Contender, albeit slightly lower in 2025, as pressure mounts from platforms embedding AI and analytics deeper into their stacks. Strengths: Proven corporate credit and collateral workflows; wide adoption across Asia-Pacific.

Jack Henry holds its Contender status, continuing to serve regional U.S. banks and midsized institutions, though without significant new competitive differentiators. Strengths: Strong presence in mid-market and community banks; mature workflow automation for SMB/commercial credit. Linedata remains a stable Contender with consistent performance in corporate and structured lending verticals. Strengths: Solid credit and portfolio management; dependable execution for structured finance use cases.

Q2 Software stays in Contender territory, continuing to address the community bank and credit union segment with steady but incremental improvements. Strengths: Strong mid-market commercial lending modules; user-friendly borrower and banker interfaces. Lentra remains a Contender, its AI-enabled onboarding and origination workflows still valuable, though its global reach appears limited. Strengths: Efficient AI-backed underwriting for SME and emerging-market lenders; modular and configurable architecture.

Comarch also holds steady as a Contender, maintaining relevance particularly in Europe and adjacent markets. Strengths: Comprehensive credit lifecycle management; strong integration with traditional banking systems. Intellect Design Arena fell from Contender to Aspirant, a signal that their commercial credit capabilities haven’t kept pace with the rapid evolution toward AI-native, cloud-first platforms. Strengths: Modular, enterprise-grade digital banking stack; configurable deployment. Global Wave Group remains an Aspirant, still useful for small institutions transitioning from manual to digital credit operations, but clearly not among the innovation leaders. Strengths: Cost-effective core workflow automation; approachable entry-point for digitizing commercial lending.

The Changing Guard (New Entrants & Exits)

Some vendors leapfrogged into the 2025 landscape, while others quietly disappeared, a sign this space is consolidating and refocusing rapidly.

New Entrants

Infosys Finacle entered as the leader. VeriPark, entered as Contender, brings modern digital onboarding, customer-facing workflows, and a strong regional presence, especially in EMEA and Africa. Strengths: Advanced digital lending journey layers; strong regional traction. Newgen Software appears as a new platform in 2025, offering low-code automation, document-AI-driven credit origination, and end-to-end lifecycle support. Strengths: Full-lifecycle automation; strong document and data AI capabilities.

SBS is new to the matrix, offering modular, API-first credit origination and collateral management, with strength across project, trade, and asset financing. Strengths: Broad financing coverage across asset, trade, and project finance; strong AI-enabled collateral and covenant workflows.

Exits

The following 2024 names are absent in 2025: EdgeVerve, Sopra Banking Software, Oracle, Tietoevry, Abrigo, and Finvolv. Their removal may indicate either strategic refocusing, consolidation, or a retreat from the competitive commercial loan origination spotlight.

Why It Matters (For Buyers, CFOs & Decision-Makers)

The shifts we observe have real implications for institutions evaluating or renewing their commercial loan origination systems:

- AI and risk automation are now non-negotiable: Platforms like Finastra, Pennant, Infosys Finacle, Newgen, and Axe Finance are embedding AI throughout underwriting, pricing, covenant monitoring, and collateral workflows. If your platform doesn’t support that, you’re effectively investing in legacy technology.

- Integration and ecosystem readiness matter more than ever: API-first architectures that can plug into credit bureaus, ERP systems, and embedded finance channels are essential as lenders expand into supply-chain finance, embedded business credit, and corporate marketplaces.

- Regional or niche strength can still matter: Vendors such as Lentra, Comarch, Nucleus Software, and SBS prove that for regional institutions or specialized credit segments (SME, structured deals, trade finance), a focused solution, even if not top-ranked globally, may deliver better ROI.

- Exit signal consolidation risks and potential vendor instability: The drop off names like EdgeVerve, Sopra Banking Software, and Oracle may reflect acquisition activity, strategic repositioning, or a retreat from CLOS-specific offerings. Buyers must carefully evaluate vendor longevity and roadmap clarity.

- New entrants disrupt the status quo, but with opportunity and risk: Platforms like Infosys Finacle, Newgen Software, and SBS offer cutting-edge capabilities, but new vendors often carry higher implementation and integration risk. Early adopters may gain an advantage, but must weigh onboarding effort and maturity.

Conclusion

Between 2024 and 2025, the commercial loan origination ecosystem will be rebalanced. Leaders such as Finastra, Infosys Finacle, Axe Finance, Pennant Technologies, nCino, Moody’s, TurnKey Lender, and Fiserv now define the direction, prioritizing AI, real-time risk monitoring, modularity, and global scalability. Contendersand aspirants continue to serve regional and niche markets, but their long-term relevance depends on how quickly they modernize. Meanwhile, new entrants like VeriPark, Newgen Software, and SBS add fresh energy and capabilities, pushing incumbents to evolve or risk being left behind. The departures of established vendors remind buyers to stay vigilant about vendor health and product roadmap.

For CFOs, credit leaders, and procurement teams: this is a pivotal moment. Choosing the right partner in 2025 isn’t just a procurement decision; it’s a strategic lever that shapes risk, scalability, and competitive positioning for years to come. If you like, I can also produce a vendor-by-vendor quick snapshot table (with quadrant movement + strengths) useful for procurement or evaluation decks.