Once viewed as compliance-first engines powering scorecards and reporting, today’s credit risk platforms are stepping into a new role, as intelligent command centers for real-time decisioning, portfolio-level risk mitigation, and proactive regulation alignment.

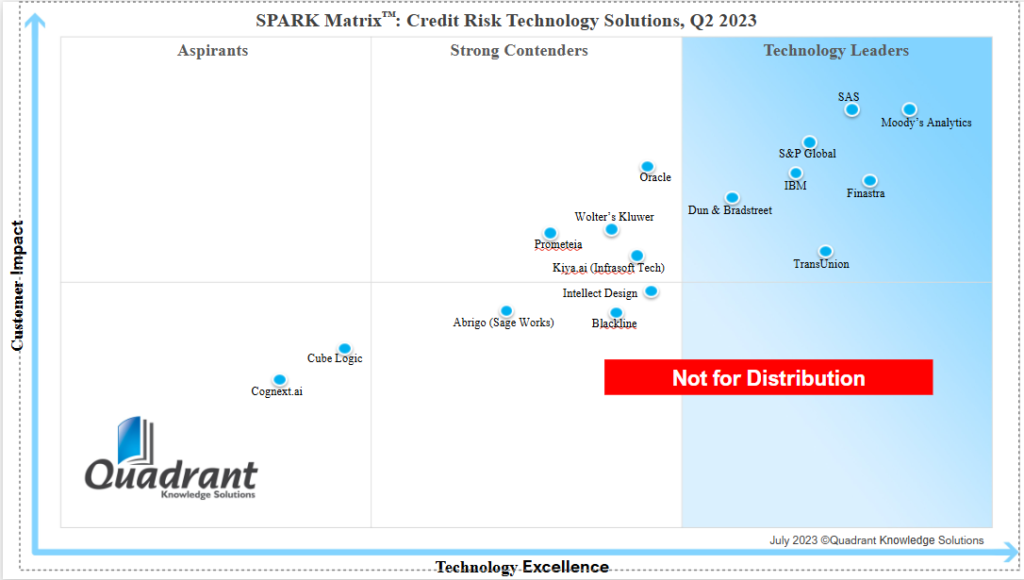

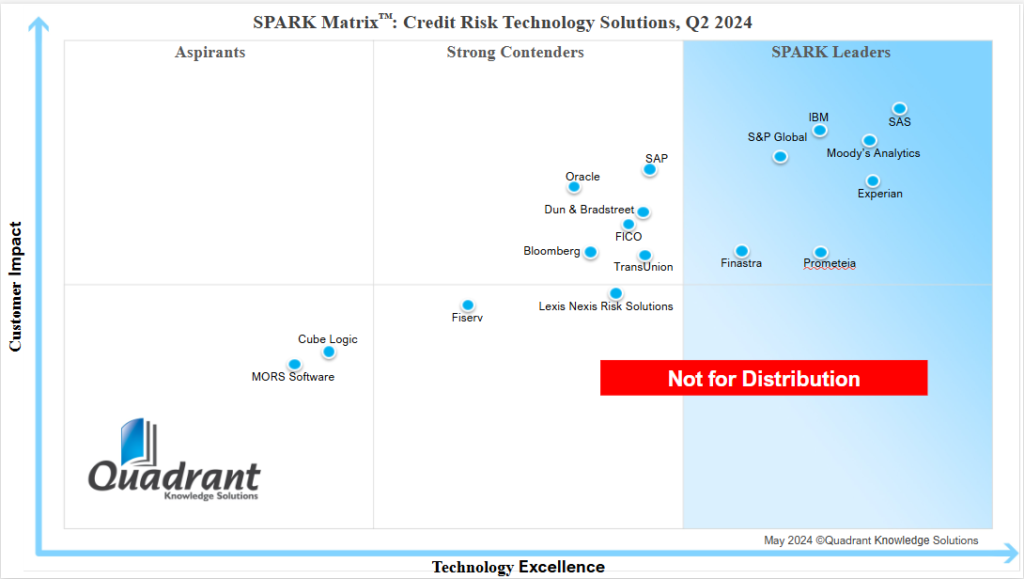

And if there’s one thing the SPARK Matrix evaluations from 2023 and 2024 make clear, it’s this: the pace of transformation has quickened. Vendors aren’t just enhancing features. They’re reimagining the very purpose of credit risk tools, from minimizing exposure to enabling strategy.

The Consistent: Holding Leadership With Intelligence

Some vendors didn’t just keep up, they led the charge.

Moody’s Analytics retained its pole position in both years, strengthening its already-formidable blend of credit risk insights, economic forecasting, ESG modeling, and regulatory intelligence. The real power lies in how Moody’s enables Tier 1 institutions to unify these dimensions into a single strategic lens, one that’s both regulatory-compliant and analytically advanced.

FIS remained consistent in its Leader status. Its platform continues to be dependable, especially for large institutions seeking a rock-solid foundation for credit operations. While it hasn’t yet pushed the boundaries on AI or real-time intelligence, its global reach and regulatory alignment keep it squarely in enterprise conversations.

Equifax, too, stood still, both in quadrant placement and platform trajectory. Its data strength remains unmatched, but in a world that demands predictive, real-time tools, execution gaps are becoming more visible. The market is watching to see if it can evolve from data provider to intelligence platform.

The Risers: Big Leaps Fueled by Bold Strategies

SAS made one of the biggest upward moves in 2024, transitioning from analytics vendor to a cloud-native risk intelligence platform. The launch of explainable AI, new model governance frameworks, and ML-infused credit scoring changed the narrative. SAS is no longer just a powerful analytics engine; it’s now a strategic advisor for credit risk teams.

CRIF also moved upward in 2024, advancing into the Major Player quadrant. Its approach? Keep it modular, intuitive, and affordable. CRIF’s traction in regional banks and mid-market institutions reflects the demand for nimble platforms that don’t require full-stack overhauls.

Oracle, which was positioned as a niche player in 2023, has climbed back into strategic consideration. With cloud-first repositioning and stronger vertical risk modeling capabilities, Oracle’s growth is more evident across APAC and European markets. Yet, its front-end experience still needs refinement.

The Drop-offs: Innovation Debt Comes Due

Even in a growing market, some platforms lost ground.

Experian, long respected for its dominance in consumer credit data, slipped in the 2024 evaluation. The core issue: platform stagnation. While others embedded AI and alternative scoring models, Experian’s broader commercial risk suite failed to evolve fast enough. The result? A demotion from Leader to Major Player.

The Non-Movers: Still in Play, But For How Long?

Some vendors didn’t rise or fall but hovered.

Pegasystems and Wolters Kluwer remained in the Niche quadrant across both years. While Pega brings automation and case workflow strength, its credit risk-specific offerings haven’t matured. Wolters Kluwer, on the other hand, remains respected for compliance and reporting, but its platform lacks the modern UX, modularity, and AI strength needed to move up the value chain.

Finastra also held its position with mild movement. While its partnership network remains robust, its credit risk stack hasn’t seen the same innovation momentum as its competitors.

So, What Changed Between 2023 and 2024?

In a word: everything.

Buyers in 2024 are demanding platforms that go beyond dashboards and compliance. They want systems that look around corners, tools that blend explainability with automation, regulatory insight with AI, and user experience with execution agility.

The most successful platforms shared several core traits:

- Embedded AI/ML for predictive scoring, real-time decisioning, and model explainability

- Composable architectures that allow clients to scale gradually without platform lock-in

- Cloud-first strategies to support regulatory agility and geographic expansion

- End-to-end workflows that tie credit policy, risk modeling, and regulatory reporting into a unified experience

Crucially, they are building for a world where credit risk is not a limiter, it’s a lens for business growth.

Final Thoughts: Credit Risk Has a New Center of Gravity

Look at the 2024 SPARK Matrix, and it’s clear, the definition of leadership has shifted. It’s no longer about legacy dominance or static compliance. It’s about intelligence, innovation, and integration.

For vendors, the path forward is bold: invest in AI-native risk engines, rethink UX, and design for adaptability.

For financial institutions, the message is direct: your next credit risk platform shouldn’t just protect the business, it should advance it.

This market is no longer about managing yesterday’s risk. It’s about forecasting tomorrow’s advantage.

According to the analysts of QKS Group, “Credit Risk Technology Solutions (CRTS) have become indispensable for banks and financial institutions, offering a suite of advanced tools to manage and mitigate credit risk. By leveraging AI and ML, these solutions enable institutions to analyse vast datasets, predict default probabilities, and assess potential losses. Key components of CRTS include credit scoring, monitoring, portfolio management, stress testing, fraud detection, compliance, and predictive modelling. These technologies empower data-driven decision-making, allowing institutions to optimize lending strategies and safeguard their financial health.“