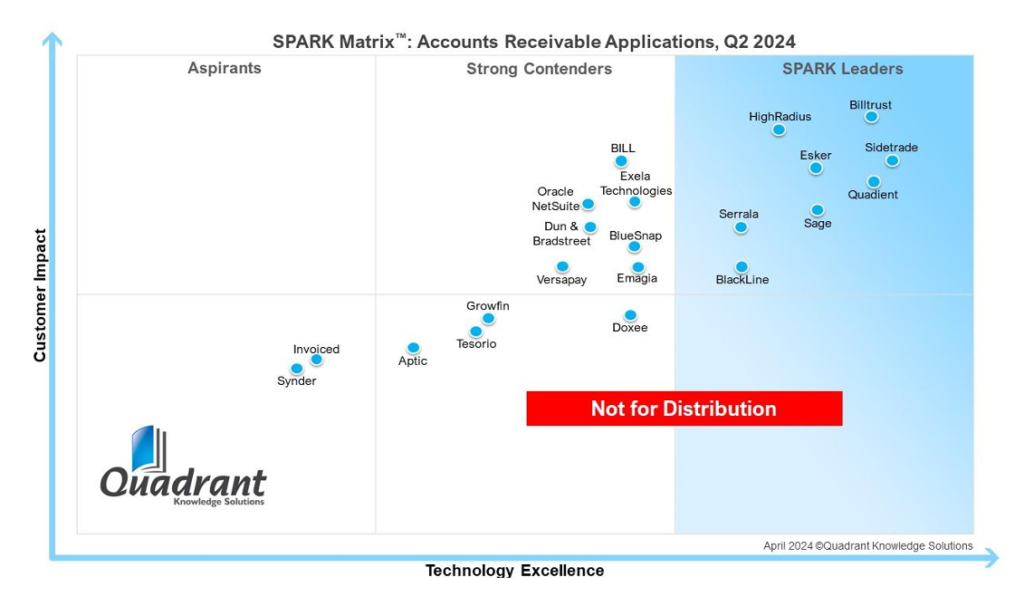

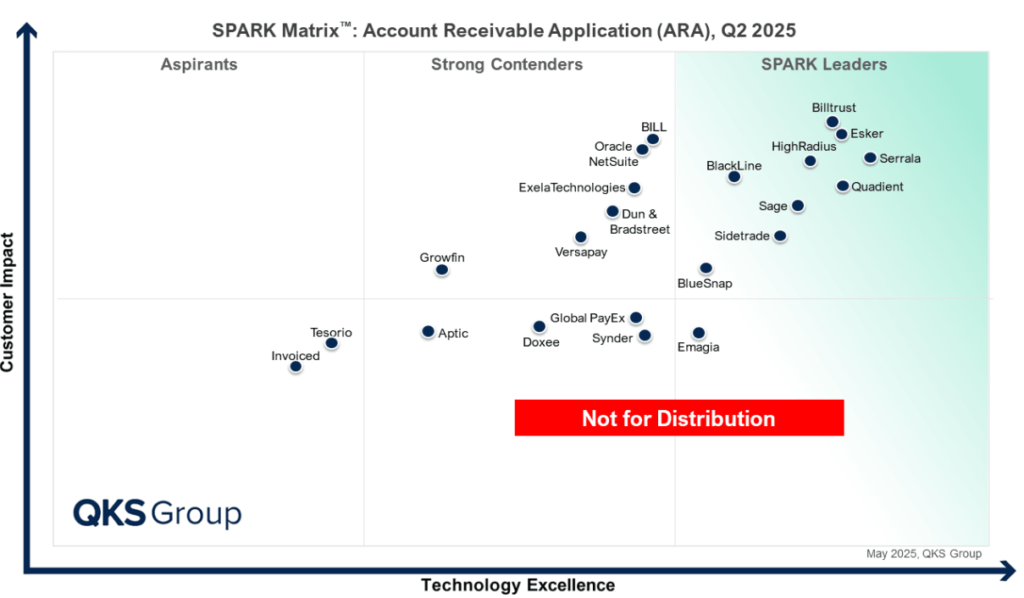

The Accounts Receivable (AR) applications market transformed between 2024 and 2025. Vendors are no longer competing on invoice automation alone but on orchestrating outcomes with operational AI, predictive analytics, and embedded finance. The 2025 SPARK Matrix™ captures this inflection point: Leaders doubled down on AI-first strategies and payment orchestration, while Contenders and Aspirants differentiated through modularity, ecosystem reach, and cost-effective deployments.

From 2024 to 2025, several vendors rose into the Leader quadrant by demonstrating AI-driven cash flow visibility and embedded payment orchestration. Others retained position but enhanced depth through ERP interoperability and composability. At the same time, regional and integration challenges prevented some Contenders from advancing.

What the SPARK Matrix Measures

The SPARK Matrix benchmarks vendors on:

- Technology Excellence

- Customer Impact

In 2025, evaluation emphasized operational AI, composability, ERP interoperability, orchestration of payments, and ecosystem-led time-to-value. Vendors able to show measurable reductions in Days Sales Outstanding (DSO), faster deployment, and customer-centric innovation advanced meaningfully.

Top Trends in 2025

1. Operational AI Becomes the New Baseline

Vendors such as HighRadius, Emagia, and Sidetrade embedded predictive AI into collections, dispute resolution, and risk scoring. This helped customers move from reactive invoice management to proactive, outcome-led AR orchestration.

2. Embedded Finance and Orchestration Differentiate Leaders

BlueSnap, Global PayEX, and Versapay blurred lines between AR automation and payment platforms by embedding global payment gateways, real-time rails, and financing options. Leaders now reduce DSO not only through automation but also by orchestrating the flow of funds.

3. Composable, Cloud-First Platforms Dominate

Vendors such as Esker, Quadient, and Oracle NetSuite advanced through modular AR suites that integrate seamlessly with SAP, Microsoft Dynamics, and Oracle ecosystems. Enterprises rewarded composability and interoperability over standalone features.

4. Compliance and Data-Led AR Gain Weight

Doxee and Dun & Bradstreet maintained quadrant strength with compliance-first and data-driven AR workflows. Their ability to serve regulated industries with e-invoicing mandates and credit risk insights positioned them strongly, though limited SMB appeal constrained movement.

5. SME-Centric Innovation Expands Market

Vendors such as Bill.com (BILL), Synder, Invoiced, and Tesorio catered to mid-market and SMB buyers with lighter deployments and modular automation. While not Leaders, their adoption momentum highlights the democratization of AR innovation.

Vendor Position Analysis

Leaders

Billtrust retained leadership with its end-to-end AR automation and B2B Supplier-Payer Network. Its partnerships with U.S. Bank and ERP providers extended reach, but international adoption of its self-service portals remains uneven. Esker climbed with AI-powered modules for cash application, deductions, and claims management. Its modularity and ERP integration made it attractive to enterprises, though SMBs find cost a constraint. Serrala held a Top 3 rank by extending GenAI into collections and credit workflows. Deep SAP integration gave strength, but limited APAC traction and high implementation costs remain challenges.

HighRadius strengthened its position with FreedaGPT, a no-code AI assistant for invoice matching and collections. Its speed-to-value methodology helped offset multi-ERP complexity, but smaller firms still find adoption costly. Quadient consolidated leadership with AI-powered dispute resolution and predictive cash application. Its ERP-agnostic integrations boosted adoption, though APAC expansion remains a gap. BlackLine advanced via Data Interconnect, adding e-invoicing compliance to its Invoice-to-Cash platform. Complexity and premium pricing restrain SMB adoption. Sage AR Automation entered the Leader quadrant in 2025, building on its Lockstep acquisition to deliver strong mid-market capabilities. While North America is a stronghold, limited APAC presence and slower enterprise support responses are barriers.

Sidetrade held leadership with its Aimie AI assistant and Data Lake benchmarking. Heavy reliance on clean historical data is a constraint, but predictive insights remain a differentiator. BlueSnap moved into leadership by embedding AR automation into its Global Payment Orchestration Platform. Its one-click checkout and global payment support appealed to enterprises, though higher TCO could slow mid-market growth. Emagia rose into the Leader quadrant in 2025, propelled by its agentic AI co-pilot Gia. Its predictive credit scoring and automated collections earned traction, though data dependency and implementation effort are ongoing challenges.

Contenders

BILL (Bill.com) stayed in the Contender quadrant with SMB-focused usability, QuickBooks/Xero integrations, and multi-payment support. Its global reach and advanced features remain limited, constraining quadrant ascent. Oracle NetSuite delivered comprehensive ERP-driven AR automation with configurable dunning and compliance. Its pricing and complexity remain barriers, but global scalability keeps it competitive. Exela Technologies maintained contender status with modular O2C solutions powered by RPA. High cost and steep learning curve limit adoption beyond large enterprises. Dun & Bradstreet offered unmatched data-driven AR and credit risk insights. Its high TCO and integration complexity remain barriers, but its Data Cloud keeps it indispensable for global enterprises. Versapay advanced through collaborative AR workflows, real-time customer portals, and virtual card automation. Limited reporting depth kept it from rising further. Growfin strengthened its contender position with intuitive, AI-driven collections and customer engagement. Workflow refinement and limited global scale remain gaps.

Global PayEX provided AI-driven AR tied to strong bank partnerships. While adoption momentum rose, its limited global footprint outside India and the U.S. constrained leadership potential. Synder gained visibility with multi-channel integrations and revenue recognition tailored to SMBs. It remains too lightweight for enterprises, keeping it in contender ranks. Doxee appealed to regulated industries with e-invoicing compliance and interactive invoices. High customization costs restrained wider adoption. Aptic maintained a regional stronghold in the Nordics with modular AR workflows. Limited global presence and complex integrations prevented further advancement.

Aspirants

Tesorio served mid-market enterprises with predictive analytics and cash flow forecasting. Its dependence on Stripe integrations and occasional reliability issues held it in the Aspirant quadrant. Invoiced gained traction with real-time reporting and self-service portals. Lack of advanced features for large enterprises kept it aspirant-level, but SME adoption remains strong.

What Should Be Taken Into Consideration?

Choosing AR platforms in 2025 means aligning vendor strengths to organizational scale. Enterprises should prioritize AI-powered orchestration, ERP interoperability, and embedded finance, while mid-market firms may benefit more from cost-effective modular deployments. Sustaining leadership requires composable architectures, outcome-linked pricing, and regional expansion. Contenders and Aspirants must sharpen ERP interoperability and expand global compliance to rise further.

According to Hetansh, Analyst at QKS Group, “Accounts Receivable Application platforms are evolving rapidly with AI and automation at their core, enabling enterprises to streamline the invoice-to-cash lifecycle. Leading solutions offer capabilities such as intelligent collections, predictive analytics, automated cash application, dispute management, and real-time customer insights. These applications are critical for improving working capital, reducing Days Sales Outstanding (DSO), and delivering a more efficient, customer-centric AR process, especially in multi-entity, global environments.”

Conclusion

The AR applications market has redefined leadership in 2025: automation alone is no longer sufficient. Leaders now orchestrate AI-driven collections, embedded finance, and composable integrations to deliver measurable business outcomes. Vendors that bridge predictive analytics, global payment orchestration, and ERP composability will shape the next phase of AR transformation.