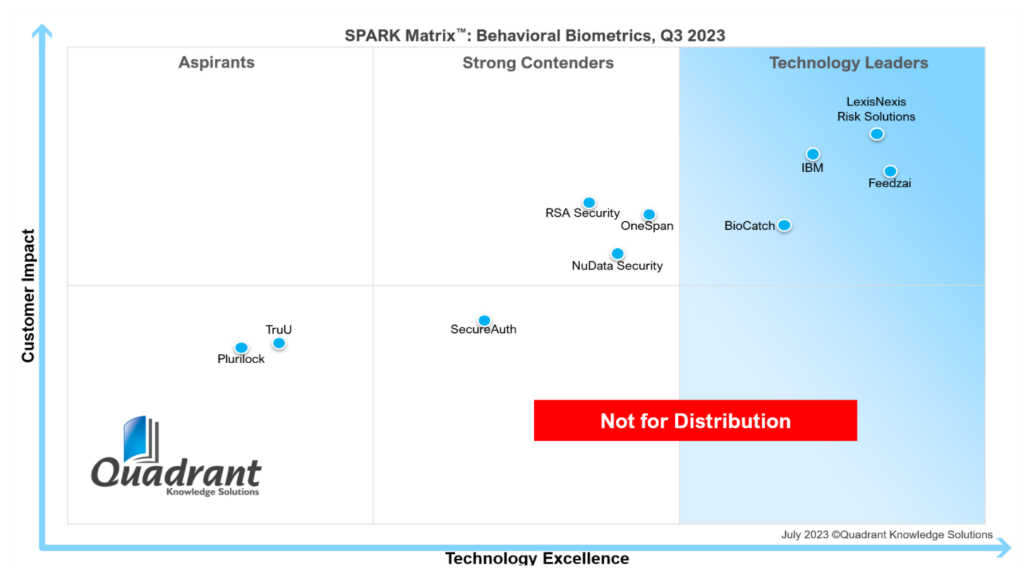

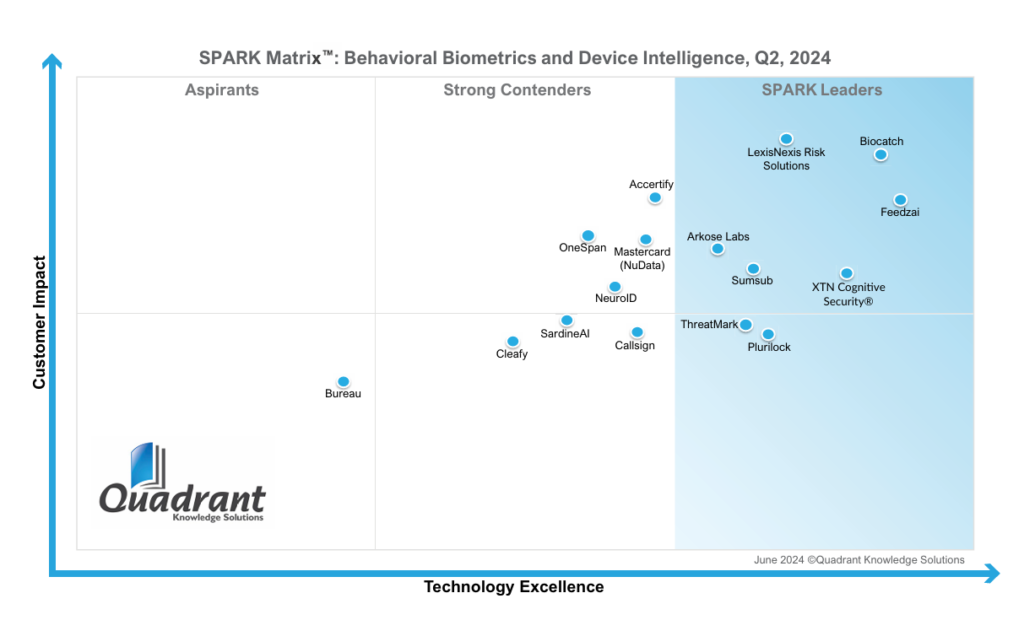

In 2023, behavioral biometrics was largely seen as an advanced but niche fraud prevention tool, a complement to multi-factor authentication rather than a core identity defense. Fast-forward to 2024, and the SPARK Matrix™ for Behavioral Biometrics & Device Intelligence paints a very different picture. In 2024, the results show the technology maturing into a unified fraud intelligence layer, where behavioral analysis is paired with device intelligence for continuous, multi-signal authentication.

The QKS Group’s SPARK Matrix™ evaluates vendors across Technology Excellence and Customer Impact, benchmarking capabilities such as continuous authentication, AI-driven risk scoring, behavioral profiling, and integration with threat intelligence. It’s used by fraud prevention leaders, financial institutions, and fintechs to map market maturity, spot innovation leaders, and identify the vendors best equipped for emerging fraud vectors like APP fraud, mule accounts, and synthetic identities.

Market Shifts Defining 2024

Between 2023 and 2024, three big trends reshaped the Behavioral Biometrics & Device Intelligence market:

1. Convergence of Behavioral and Device Intelligence

Vendors moved beyond pure behavioral analytics, integrating device fingerprinting (OS, browser, IP, usage patterns) to build richer, multi-layered risk profiles. This not only reduced false positives but also strengthened defenses against malware, bots, and emulator-based fraud.

2. Real-Time, Session-Long Authentication

Static checks at login are giving way to continuous monitoring across the session lifecycle. This trend is crucial as fraudsters increasingly hijack authenticated sessions using social engineering or session replay attacks.

3. Expansion of Use Cases

Whereas 2023 deployments focused on account takeover (ATO) prevention, 2024 leaders are targeting APP fraud, mule detection, scam disruption, and PSD2/SCA compliance in a unified architecture, making the technology a central fraud management hub rather than a bolt-on.

Leaders: Rising Entrants and Evolving Veterans

In 2023, the Leaders quadrant featured LexisNexis Risk Solutions, IBM, Feedzai,andBioCatch. By 2024, IBM had exited the Leaders tier entirely, while new names surged into the top ranks. BioCatch, LexisNexis, and Feedzai held onto their leadership positions, but each expanded its scope. BioCatch, for example, moved from being a behavioral biometrics specialist to offering a full Behavioral Biometrics & Device Intelligence stack, powered by its patented Continuous Behavioral Sequencing (CBS) technology and new BioCatch Scout tool for visualizing mule networks.

Arkose Labs, Sumsub,and XTN Cognitive Security® entered the Leaders quadrant for the first time, each bringing distinctive strengths: Arkose Labs with multi-layered threat intelligence, Sumsub with 200+ behavioral data point analysis, and XTN with omnichannel behavioral analytics and contextual threat detection.

The 2024 lower Leader quadrant introduced ThreatMark and elevated Plurilock from its 2023 Aspirant position. ThreatMark’s anti-fraud suite, with deep learning profile engines, and Plurilock’s focus on internal fraud prevention through continuous interaction authentication, reflect a growing appetite for specialized deployments that can integrate into broader enterprise fraud ecosystems.

Contenders: Holding Ground, Facing Pressure

The Contender category saw OneSpan and NuData Security (Mastercard) retain their competitive presence, while Accertify and NeuroID joined the tier. This reflects the segment’s mix of established fraud prevention platforms expanding into behavioral biometrics and newer entrants bringing niche behavioral intelligence.

Sardine AI, Callsign, and Cleafy occupy the lower Contender quadrant in 2024, bringing device-behavior fusion and real-time payment fraud detection but lacking the scale and breadth of Leaders.

Aspirants: Emerging, But Not Yet Scaling

BureauID emerges as an Aspirant in the 2024 SPARK Matrix™, marking its entry into the Behavioral Biometrics & Device Intelligence market. The vendor is building capabilities that blend behavioral analytics with device intelligence to address targeted use cases, particularly in regions where adoption is still emerging. Its early-stage positioning reflects a growing commitment to technology investment and expanding fraud detection coverage.

However, BureauID’s current challenge is scaling its customer base and maturing its platform to handle high-volume enterprise needs, advanced multi-model ML, and seamless integration with wider fraud management ecosystems. With accelerated R&D, stronger partnerships, and proven large-scale deployments, BureauID could transition into a competitive Contender in future evaluations.

Who Rose, Who Slipped, and Who Exited

- Rising: Arkose Labs, Sumsub, XTN Cognitive Security®, ThreatMark, and Plurilock all climbed into leadership territory for the first time.

- Holding: BioCatch, Feedzai, LexisNexis maintained leadership through sustained innovation and expanded intelligence layers.

- Slipping/Exiting: IBM and RSA Security, both Leaders or strong Contenders in 2023, were absent from the 2024 matrix, signaling possible shifts in product focus or market traction. TruU also exited from its Aspirant position.

Final Take: 2024 Is the Year of Unified Fraud Intelligence

The SPARK Matrix™ for Behavioral Biometrics & Device Intelligence in 2024 confirms a major strategic shift: the technology is no longer just about how a user interacts, but also where and with what device. Leaders are those who combine behavioral profiling with device intelligence, advanced analytics, and fraud consortium data to deliver session-long, real-time authentication without compromising user experience.

According to Siddharth Arya, principal Analyst at QKS Group:

“Behavioral Biometrics and Device Intelligence solutions provide continuous, passive authentication by analyzing users’ behavioral and cognitive attributes, such as keystroke dynamics and device handling. Leveraging advanced analytics and machine learning, these solutions generate real-time behavioral risk scores, reducing false positives and enhancing security. With the rise of sophisticated fraud techniques like APP fraud and synthetic identity fraud, continuous authentication is crucial. These solutions offer robust and scalable capabilities, ensuring seamless customer experiences and comprehensive protection against evolving cyber threats. By monitoring digital behaviors, they help organizations maintain security without compromising user experience.”

For financial institutions, the choice now isn’t whether to deploy behavioral biometrics; it’s which vendor can integrate it seamlessly into a broader fraud prevention strategy that’s adaptable, compliant, and intelligence-driven.

1 Comment

One of the best articles I’ve read on the topic—clear, concise,

and very useful.