Digital trust has entered a new era. Between 2024 and 2025, the Behavioral Biometrics & Device Intelligence market has evolved from experimental deployment to strategic adoption. Once seen as a niche extension of fraud prevention, behavioral biometrics is now a cornerstone of financial crime compliance, continuous authentication, and AI-led identity orchestration.

The SPARK Matrix™: Behavioral Biometrics & Device Intelligence study captures this transformation in full. Compared to the 2024 edition, the new study reveals an ecosystem that has expanded in maturity, vendor diversity, and technological depth. The market is no longer defined by how users type or swipe, it’s now about how organizations analyze behavior, context, and intent as a single source of truth.

Behavioral Biometrics Redefined

Behavioral biometrics has always been about verifying users by how they behave, not just who they claim to be. But in 2025, the definition has widened dramatically. Technology now unites behavioral analytics, device intelligence, and contextual telemetry to build a real-time, continuous view of identity risk.

This convergence has been driven by three forces shaping the digital finance landscape:

- AI-powered financial crime, where fraudsters use generative AI to mimic legitimate customer behavior.

- Tightening regulatory mandates, from PSD2 Strong Customer Authentication in Europe to AMLD6 and global AI governance frameworks.

- User experience expectations, with financial institutions demanding frictionless yet secure digital journeys.

As a result, the new generation of Behavioral Biometrics & Device Intelligence platforms doesn’t just authenticate logins, it continuously evaluates every user interaction across devices, browsers, and networks. The result is a living, adaptive identity that evolves as customers do.

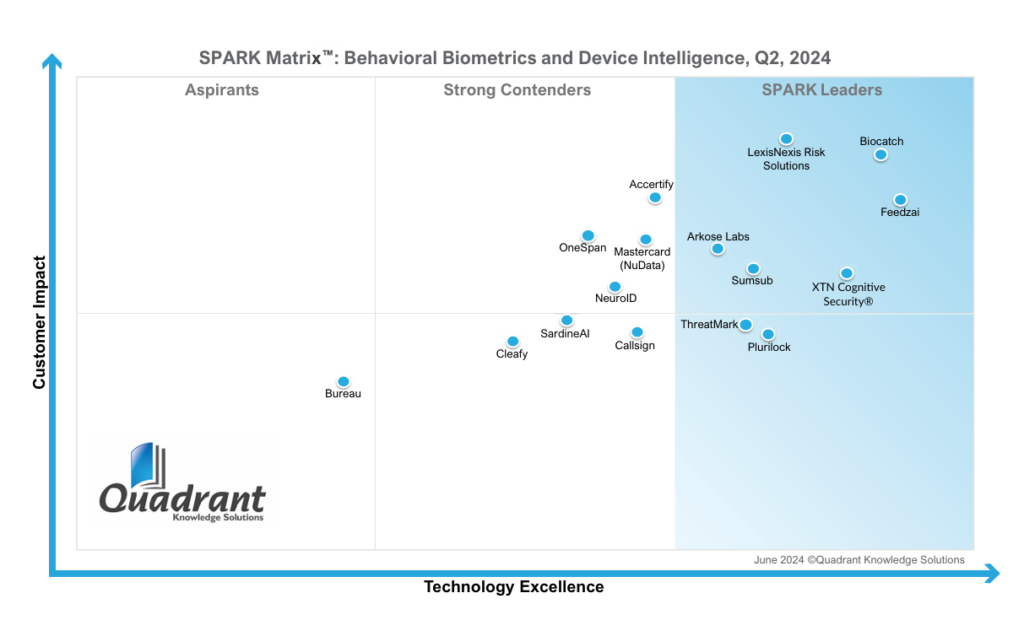

2025 Market Shifts: Intelligence Over Authentication

In 2024, the category was still finding equilibrium. Vendors like Arkose Lab, Feedzai, BioCatch, Sumsub, XTN Cognitive Security®, ThreatMark, Plurilock, and LexisNexis Risk Solutions led the market with AI-enabled risk engines and advanced behavioral profiling. Others, such as Accertify, Onespan, Mastercard, NeuroID, SardineAI, Callsign, Cleafy, and Beureau were emerging vendors, rapidly climbing the maturity curve.

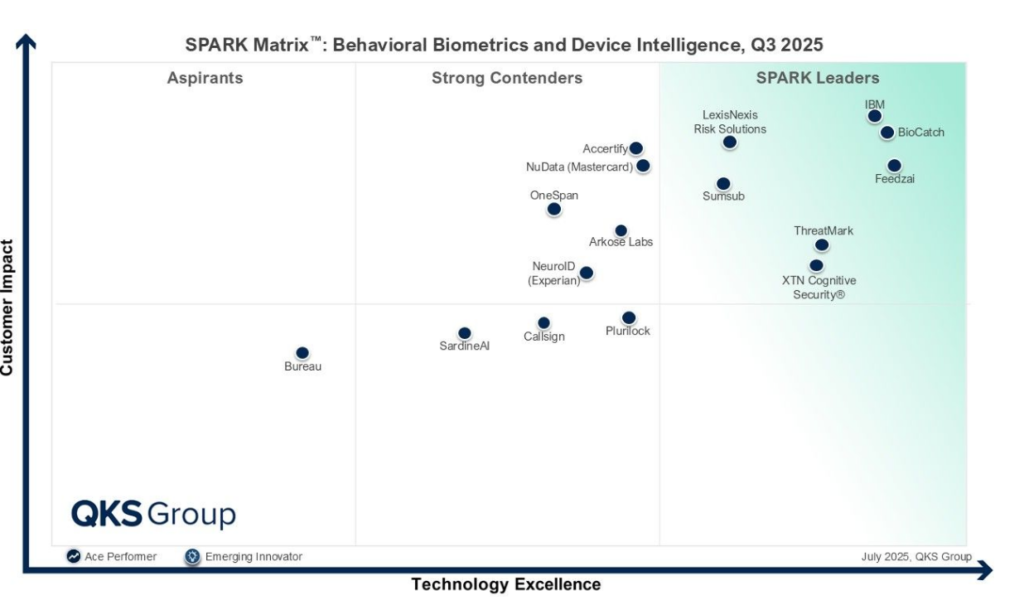

By 2025, the balance of power will have changed once again. Behavioral Biometrics has become inseparable from Device Intelligence, forming a unified risk decisioning layer that powers fraud, KYC, and AML ecosystems alike. Platforms now integrate behavioral biometrics with network telemetry, transaction context, and machine-learning risk orchestration to create a continuous fraud defense fabric.

The market also saw growing demand from new verticals, fintechs, crypto exchanges, and digital-first insurers, where identity attacks have become more sophisticated. With Authorized Push Payment (APP) and synthetic identity fraud accelerating, continuous authentication is no longer optional. It’s the foundation of digital resilience.

Leaders Who Stayed, Vendors Who Rose, and Those Who Faded

The SPARK Matrix 2025 draws a compelling contrast to the 2024 quadrant, confirming both consolidation and renewal within the top tier.

Consistent Leaders:

The continuity at the top signals a maturing field. BioCatch, Feedzai, LexisNexis Risk Solutions, XTN Cognitive Security®, ThreatMark, and Sumsub retained their leadership positions year-over-year. These vendors have sustained innovation velocity by pairing behavioral analytics with device-risk intelligence, cloud scalability, and AI explainability. Each has translated technical depth into tangible customer impact, large-scale deployments, reduced false positives, and faster time-to-trust.

- BioCatch continued to set the benchmark with its patented Continuous Behavioral Sequencing (CBS) engine, expanding mule-account and social-engineering detection. Its data consortium, connecting fraud telemetry across banks and networks, strengthened collective intelligence against AI-driven scams.

- Feedzai’s RiskOps platform reinforced its leadership with unified behavioral, device, and transaction analytics, integrating anomaly detection directly into payment and AML workflows.

- LexisNexis Risk Solutions sustained global reach through the synergy of BehavioSec® and ThreatMetrix®, enabling layered behavioral and contextual risk scoring.

- XTN Cognitive Security® and ThreatMark deepened their specialization in cognitive analytics and APP-fraud detection, while Sumsub consolidated its dominance in fintech and crypto onboarding, leveraging behavioral intelligence for real-time identity orchestration.

New Entry:

The notable surprise in 2025 is IBM, entering the leadership quadrant. Its presence underscores a broader enterprise pivot toward behavioral AI. IBM’s integrated fraud-risk framework now combines behavioral telemetry with large-language-model-based analytics to provide adaptive, session-aware authentication at scale. Its return reflects how legacy security vendors are reinventing themselves for the behavioral era.

Falling Positions:

Two vendors that held leadership in 2024, Arkose Labs and Plurilock, slid into the Contenders category in 2025. For Arkose, the shift reflects a recalibration toward bot-defense and gaming fraud niches rather than broad behavioral orchestration. Plurilock, meanwhile, remains technically strong in workforce authentication but faces limited geographic expansion and customer diversity compared to the multi-vertical leaders.

Upward Mobility and Stability:

Several 2024 contenders, Accertify, NuData (Mastercard), OneSpan, and NeuroID (Experian), held their ground within the upper mid-tier, inching closer to leadership on technology excellence. Accertify’s integration of device telemetry into its enterprise fraud stack and NeuroID’s growing traction in user-journey analytics signal rising potential.

Bureau, an Aspirant, remained in the same position as 2024, even though it had a wider APAC adoption across neobanks and BNPL platforms.

Overall, the quadrant’s shape reveals a consolidating market: ten vendors now cluster across the upper two tiers, with smaller gaps in both axes. Customer impact, more than technology novelty, determines differentiation.

AI, Device Intelligence, and Contextual Analytics Take Center Stage

The most striking feature of the 2025 Behavioral Biometrics landscape is the deep embedding of AI, not as an add-on but as the engine of behavioral intelligence. Vendors are moving beyond single-model ML approaches to multi-model, context-aware AI architectures capable of learning, adapting, and re-scoring in real time.

Behavioral profiles now draw from a broader range of inputs: keystroke dynamics, swipe cadence, mouse velocity, device posture, network anomalies, and even session-level emotional inferences. These signals feed advanced risk engines that continuously determine trustworthiness, enabling banks to make instantaneous decisions on whether to challenge, allow, or block an interaction.

At the same time, device fingerprinting has matured into a standalone differentiator. Solutions collect thousands of data points, from browser attributes and IP ranges to OS versions and app integrity checks, to detect emulators, bots, and cloned devices. The integration of behavioral analytics with device context ensures accuracy while maintaining a frictionless user experience.

This convergence of AI, behavioral telemetry, and device intelligence is giving rise to a new market subcategory: Behavioral Intelligence Platforms. These platforms unify fraud detection, identity assurance, and risk orchestration into a single, continuous layer of digital trust.

Challenges Ahead: Privacy, Transparency, and Integration

With expansion comes complexity. As behavioral data becomes more granular and continuous, maintaining regulatory compliance and ethical transparency is a growing challenge. Vendors are increasingly expected to demonstrate explainable AI (XAI) capabilities that regulators and auditors can interpret.

However, the industry’s response has been encouraging. Vendors are introducing hybrid deployment models, secure data sharing frameworks, and configurable risk policies to ensure compliance with GDPR, CCPA, and evolving AI governance norms. As a result, institutions can now achieve both continuous authentication and continuous compliance, a balance that defines the 2025 market.

From Detection to Prediction

The QKS 2025 study frames this evolution succinctly: Behavioral Biometrics & Device Intelligence is shifting from detecting fraud to predicting it. The next generation of solutions will not only verify identity but also anticipate risk trajectories.

According to Vishal Jagasia, Senior Analyst at QKS Group, “Behavioral Biometrics and Device Intelligence is a technology that passively and continuously authenticates users by analyzing behavioral, cognitive, and response-based attributes—such as keystroke dynamics, device handling, touchscreen interactions, mouse movements, navigation patterns, form context, and data familiarity—across the customer lifecycle. By leveraging machine learning and advanced analytics to generate real-time behavioral risk scores, this capability reduces false positives, accelerates threat detection and response, and enables a seamless, low-friction user experience in high-assurance environments.”

Final Take: The Age of Continuous Trust

Between 2024 and 2025, the Behavioral Biometrics & Device Intelligence market transitioned from reactive defense to proactive orchestration. The technology no longer plays a supporting role; it’s the invisible foundation of secure, compliant, and intelligent digital ecosystems.

Leaders like IBM, BioCatch, Feedzai, LexisNexis, XTN, ThreatMark, and Sumsub have proven that behavioral intelligence can scale globally. Rising players like Accentify, NuData, Onespan, Arkose Lab, NeuroID, Plurilock, Callsign, and Sardine AI demonstrate how innovation and agility continue to reshape this domain. Together, they signal a unified direction. An era where behavior and device intelligence merge to create continuous, cognitive trust. As digital ecosystems expand and fraud grows more sophisticated, behavioral biometrics will define the future of digital identity, subtle, seamless, and always-on.

1 Comment

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.info/register?ref=IHJUI7TF