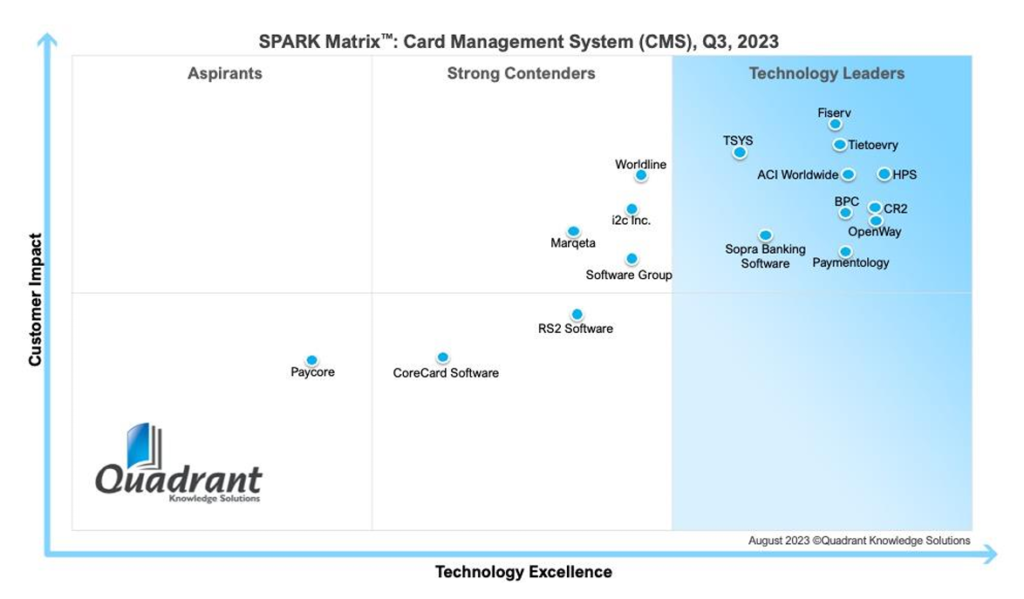

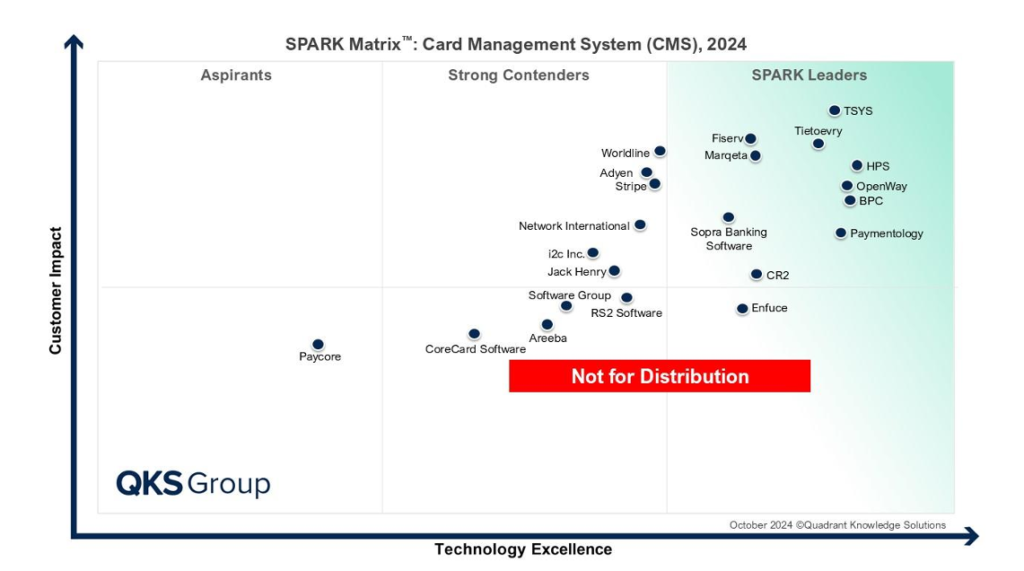

Card management systems (CMS) are no longer just operational backbones that ensure cards work behind the scenes. They have become central to the payments value chain, orchestrating not just issuance and settlement, but also expense management, ERP integration, and AI-powered fraud protection. The SPARK Matrix™ for Card Management Systems from QKS Group illustrates how rapidly this market is maturing. A comparison of the 2023 and 2024 editions highlights not only the vendors that held their ground, but also those that rose into leadership positions and those that slipped. Together, the findings paint a picture of a market that is shifting from incremental feature updates to becoming true orchestration infrastructure for financial institutions.

What is the SPARK Matrix™?

The SPARK Matrix™ evaluates vendors across two essential dimensions:

- Technology Excellence: covering criteria such as card lifecycle management, multi-channel payments, KYC and account onboarding, clearing & settlement, real-time fraud detection, scalability, and API-led integration.

- Customer Impact: capturing market presence, ease of deployment, customer service, product strategy, and unique value proposition.

Unlike static rankings, the Matrix reflects real-time market relevance and is widely used by banks, fintechs, and payment providers to benchmark vendor maturity and roadmap alignment.

Market Trends: What Changed Between 2023 and 2024?

Several shifts explain the realignments seen in the 2024 CMS SPARK Matrix:

- Corporate Card Issuance Goes Mainstream: Platforms now embed expense management and ERP tie-ins as standard, especially in sectors like financial services, healthcare, and technology.

- From Multi-Channel to Omnichannel: 2023 emphasized QR, NFC, and tokenization; by 2024, the expectation was seamless orchestration across card, mobile, and digital channels.

- AI-Driven Fraud Management: Real-time, risk-scoring fraud detection moved from “add-on” to a core differentiator.

- ERP and Ecosystem Integration: CMS is no longer standalone; 2024 highlighted tighter integration with ERP and accounting systems for reconciliation and compliance.

- Sustainability and Transparency: Vendors like Enfuce introduced carbon-footprint insights, signaling a growing demand for green finance features in CMS.

Leaders Quadrant: Consistent, Rising, and Declining

One of the most striking aspects of the 2023–2024 comparison is the consistency at the top. Nine vendors retained their leadership positions across both years: TSYS, Tietoevry, HPS, OpenWay, CR2, Paymentology, BPC, Sopra Banking Software, and Fiserv. These firms represent the backbone of the global CMS market, combining proven scale with steady, incremental innovation.

For example, TSYS continued to strengthen its role in corporate card issuing and ERP integration, even if its modernization pace remains an area to watch. Tietoevry’s modular CMS, combined with strong compliance credentials under PSD2 and PCI-DSS, reinforced its European and global positioning. HPS, with its PowerCARD suite, maintained an edge in providing visibility and automation in expense reporting, while OpenWay’s WAY4 platform demonstrated unmatched agility in supporting embedded finance and loyalty management. CR2 consolidated its reputation with a cloud-based architecture and analytics-driven QR withdrawal features, and Paymentology reinforced its relevance as a cloud-native, real-time control and fraud-first vendor. BPC, through SmartVista, maintained strength in analytics and spend insights, particularly for corporate issuers. Sopra Banking Software remained stable with scalable fraud prevention and reporting, and Fiserv underlined its API-first roadmap by blending real-time card controls with ERP integrations.

Contenders and Aspirants: Holding Ground but Struggling to Break Through

Beneath the Leaders, several vendors continued to appear in the covered vendor lists but without significant upward movement. CoreCard Software, i2c, RS2, and PayCor remained relevant but failed to leap into leadership, often due to limited global scale or insufficient orchestration capabilities. The 2024 edition introduced new covered vendors such as Adyen, Stripe, Jack Henry & Associates, and Network International. These entrants bring credibility through issuing-as-a-service models and regional strengths, but they have yet to reach the depth and breadth required for global leadership.

Exits and New Entrants

The most notable exits were ACI Worldwide and Worldline, whose absence in 2024 highlighted the market’s unforgiving pace. Their departure underscores a key lesson: legacy market presence is insufficient if vendors fail to continuously innovate. ACI Worldwide, despite being a globally recognized name in payments, lost its Leader status in 2024, suggesting slower momentum in CMS-specific innovation compared to peers. Worldline, which had been covered in 2023, also failed to appear in the Leaders quadrant the following year, signaling challenges in aligning its CMS offerings with the market’s demand for AI-driven orchestration and ERP tie-ins.

At the same time, 2024 welcomed a wave of new entrants, including Areeba, Enfuce, Euronet Worldwide, Marqeta, Adyen, Stripe, Jack Henry & Associates, and Network International. This influx reflects the rising power of regional specialists, API-first platforms, and sustainability-driven innovators who are reshaping the CMS competitive landscape. Areeba leveraged its strong MENA presence to enter the Leaders quadrant with a focus on real-time fraud and compliance. Enfuce brought a sustainability angle to the market, offering carbon footprint tracking within its cloud-native platform. Euronet Worldwide also rose to prominence, bringing advanced fraud detection and multi-channel scale to its CMS offerings. Perhaps most notably, Marqeta transitioned from being recognized as a modern issuer in 2023 to achieving full-fledged Leader status in 2024, largely on the strength of its developer-friendly APIs and flexible issuance capabilities.

Final Take: CMS is Becoming Orchestration Infrastructure

The CMS market between 2023 and 2024 illustrates a decisive trend:

- 2023 was about catching up with mobile payments and multi-channel functionality.

- 2024 is about CMS platforms becoming orchestration infrastructure, integrating corporate cards, ERP, fraud AI, and even sustainability analytics.

The winners are those that marry agility with scale, Paymentology’s cloud-native speed, Fiserv’s API breadth, Enfuce’s sustainability edge, and Marqeta’s developer-first DNA.

The losers are vendors who failed to evolve beyond card issuing into full ecosystem integration.

According to Pradnya Gugale, Principal Analyst at QKS Group,

“Card Management Systems are becoming the digital core of modern payments infrastructure. What began as platforms for issuing and processing has now expanded into unified systems that connect fraud prevention, analytics, and ERP integration. As financial institutions pursue real-time orchestration and embedded finance capabilities, CMS platforms are redefining how banks and fintechs deliver value, compliance, and innovation at scale.”

Conclusion: What Buyers Should Prioritize

For financial institutions and fintechs, vendor selection in 2024 and beyond is about more than functional coverage. Buyers should prioritize CMS platforms that can deliver omnichannel orchestration, real-time fraud detection, and seamless ERP integration. Sustainability features, while still emerging, are increasingly important differentiators. Perhaps most importantly, the market is rewarding vendors who can combine agility with scale, those able to rapidly adapt to new use cases while maintaining robust global support.

In short, the CMS market is no longer about managing cards; it is about orchestrating financial ecosystems. The vendors that recognize and act on this shift will be the ones to shape the next generation of payments infrastructure.