Cloud FP&A has spent the last two years growing from “cloud economics plus smarter forecasting” into a genuinely operations-aware performance platform. The 2024 SPARK Matrix spotlighted that by elevating account reconciliation, rule-based automation, and in-product RPA from nice-to-haves to selection drivers. 2025 doubles down on those expectations by rewarding vendors that can operate FP&A with embedded AI. It also includes scaling across multi-entity models, and interoperates natively with ERP, CRM, HCM, and BI estates.

This blog is more than a leaderboard shuffle. It’s a signal that finance transformation is now measured by closed-loop execution, plan → actuals → variance → re-plan, rather than by modeling horsepower alone.

Vvvd Akhilesh, Principal Analyst, Qks Group, says that;

“The Cloud FP&A landscape is rapidly transforming, fueled by the convergence of AI, advanced analytics, and cross-functional planning frameworks. Enterprises are moving beyond static spreadsheets toward intelligent, cloud-native platforms that enable continuous forecasting, dynamic scenario modeling, and real-time business alignment. The rise of generative AI and agentic systems is redefining finance workflows from autonomous forecasting and variance analysis to AI-generated narratives and predictive recommendations. As organizations demand faster, data-driven decisions across volatile markets, FP&A platforms are evolving into strategic command centers that integrate financial, operational, and ESG planning on a unified layer. Moreover, the shift toward xP&A and real-time ERP integration is breaking down functional silos, enabling finance teams to act as agile partners to the business, driving resilience, speed, and strategic foresight at scale.”

What the SPARK Matrix Measures and Why It Matters in 2025

QKS Group’s SPARK Matrix evaluates Cloud FP&A platforms along:

- Technology Excellence

- Customer Impact.

In practice, that means: the engines and architectures that power elastic, in-memory calculations; the maturity of AI/ML for predictive workflows; the depth of automation and RPA; and the ability to integrate bi-directionally with core systems.

It also means the real-world side of adoption: time-to-value, enablement quality, security and governance, partner delivery strength, and measurable outcomes in complex environments. In 2025, some vendors turn AI from an assistive overlay into agentic, finance-specific operators that sustain live interoperability. They include SAP, Oracle, Microsoft, Salesforce, and Power BI, are the ones separating from the pack.

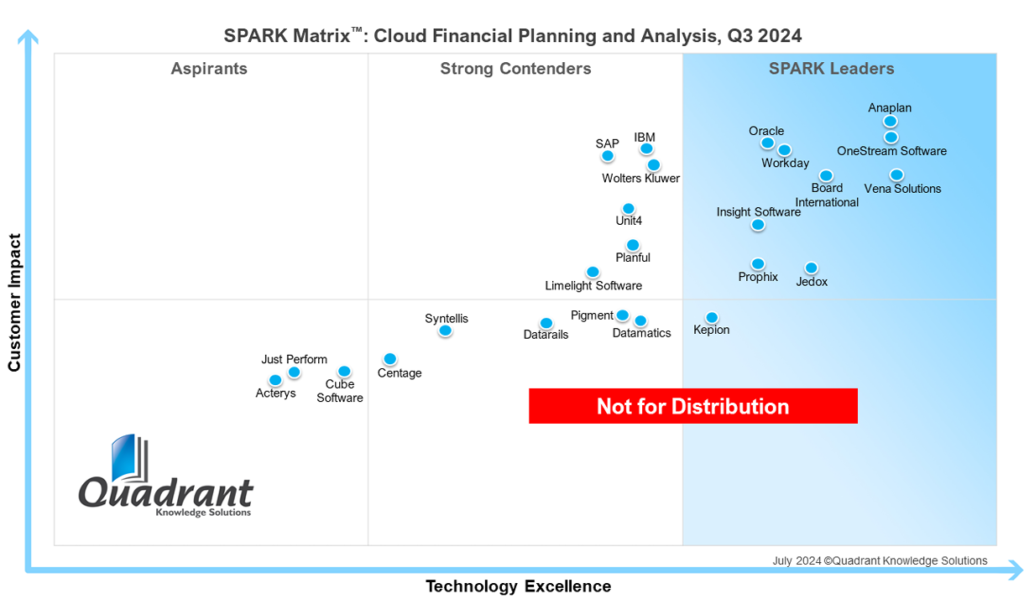

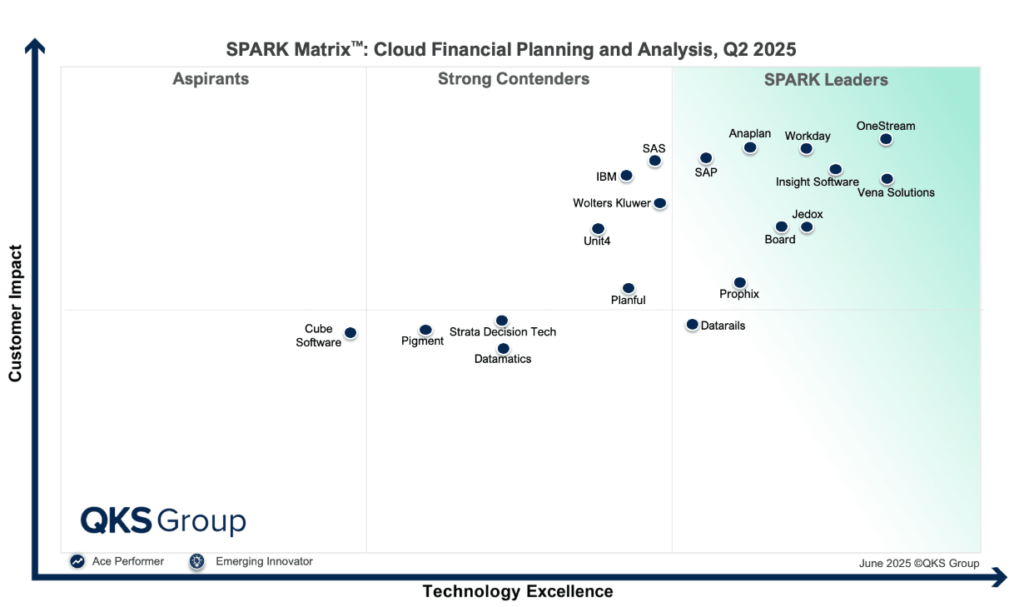

2025 Leaders vs 2024 Leaders

What Changed and Why:

The Leader quadrant in 2025 includes OneStream, Vena Solutions, Workday, Insight Software, Anaplan, SAP, Jedox, Board, and Prophix, with Datarails occupying the Emerging Leader quadrant.

The continuity is striking: many 2024 leaders – Anaplan, Workday, OneStream, Vena, Board, Prophix, Insight Software, and Jedox retain their position by pairing mature modeling with operationalized automation and strong connector ecosystems. The movement, however, tells the real story.

Vena Solutions retains leadership by pairing the familiarity of Microsoft 365/Excel with an enterprise-grade FP&A engine (CubeFLEX™). It gives finance teams governed, multi-dimensional models without abandoning spreadsheet workflows. The platform centralizes plans, actuals, and assumptions with version control, audit trails, and role-based permissions. It also integrates bi-directionally with core ERP/CRM/BI systems (e.g., Microsoft, NetSuite, Salesforce, Power BI) for live refresh, drill-through, and write-back. AI is embedded across the workflow of Vena Copilot accelerated analysis and narrative creation (including in Microsoft Teams). Meanwhile, Vena Insights (Power BI/DAX) supports self-service dashboards and ad-hoc exploration. Time-to-value is strengthened by Template Studio and industry-specific Preconfigured Solutions that package models, reports, and best-practice logic. Beyond budgeting and forecasting, Vena expands into consolidation, account reconciliation, ESG, incentive compensation, and profitability analysis.

SAP was named a Leader in 2025. It is aligning SAP Analytics Cloud (SAC) for Planning with S/4HANA and leveraging HANA for in-memory recalculation. This move helps to deliver the core-to-plan alignment that the large enterprises expect. Datarail rose from Contender in 2024 to emerging Leader in 2025. The platform’s thesis, Excel-aligned workflows with governed, centralized control, has matured into a credible option for upper mid-market and select enterprise segments that want enterprise-grade oversight without abandoning spreadsheet familiarity.

The rest of the Leaders earn their status for distinct reasons:

OneStream continues to set the pace for unified CPM, coupling close and consolidation with planning, reporting, analytics, and a deep marketplace (Solution Exchange) that adds account reconciliation, ESG, tax provisioning, and more, without splintering the data model. Its Sensible AI portfolio integrates time-series forecasting, scenario modeling, model health monitoring, and natural-language insights directly into workflows.

Workday continues to prove out its Elastic Hypercube architecture, fast, high-dimensional models, and real-time scenarios, plus tight integrations across Workday ERP/HCM and third-party systems. Buyers still need to plan for dashboard UX constraints and integration effort in non-Workday estates, but the platform’s global partner ecosystem and embedded ML keep it a safe, scalable choice.

Anaplan, Jedox, Board, Prophix, and Insight Software round out the 2025 Leader quadrant by doubling down on their differentiators: Hyperblock™-driven connected planning at enterprise scale (Anaplan); AIssisted™ Planning with integrated SSOT EPM (Jedox); BEAM/HBMP modeling and proprietary forecasting (Board); pragmatic modeling plus Power BI integration and prebuilt connectors (Prophix); and BI/OLAP-rooted continuous re-forecasting with compatibility across 140+ ERPs (Insight Software).

Strong Contenders and Contenders in 2025

The New Middle of the Market:

The Strong Contenders in 2025, SAS, IBM, Wolters Kluwer, Unit4, and Planful, are more analytically confident than a year ago. SAS’s appearance is telling: the market is rewarding statistical rigor and predictive depth applied to finance workflows rather than sandboxed in data science teams. IBM, Wolters Kluwer, Unit4, and Planful retain broad credibility and partner reach, but the bar has risen. To challenge the Leaders in 2026, they will need to show agentic AI embedded directly in reconciliation, reporting, and rolling forecast operations, not just forecasting accuracy on standalone models.

The Emerging Contenders, Strata Decision Technology, join Datamatics and Pigment. Strata’s specialty in healthcare planning and cost analytics is a reminder that vertical depth can trump horizontal breadth when the domain is complex. Pigment remains a strong modeling environment, but must articulate scenario throughput at scale, road-mapped automations for reconciliations and variance workflows, and how it will keep concurrency fast during peak cycles. Datamatics holds ground as a value-focused option where time-to-value and lean operations matter.

Why “Aspirant” Status Persists into 2025

Cube Software remains an Aspirant consecutively in 2023, 2024, and 2025. There is plenty to like: a spreadsheet-native experience for Excel and Google Sheets that finance teams adopt quickly; connectors into core ERPs, CRMs, and data warehouses; Cube AI and Cube Copilot features for narrative generation and anomaly detection; and preconfigured templates for P&L, cash flow, and rolling budgets. For mid-market teams, those strengths translate into quick wins with minimal IT.

But the same design choices create ceilings for enterprise scenarios. Spreadsheet-native recalculation can show latency when models get very large and concurrent users spike. Multi-entity, cross-border planning with intercompany complexity pushes the governance and audit trail expectations higher than Cube can always meet without custom work. Global coverage is still concentrated in North America and parts of Western Europe, with limited localized content for Latin America, the Middle East, Africa, and Asia Pacific. The net result is a platform that shines for agile mid-market finance teams but has more to prove on enterprise scale, verticalized content, and zero-latency orchestration before it climbs.

Who Rose, Who Fell, and Who’s Missing in 2025

Year-on-year movements are a useful proxy for what buyers value. SAP’s elevation confirms that live ERP connectivity, industry packs, and in-memory scale are differentiators when FP&A is expected to be continuous and audit-ready. Datarail’s promotion shows how Excel-aligned governance, combined with better automation and integration, can meet finance where it already works. SAS’s entry into Strong Contenders and Strata Decision Tech joining the Contenders highlight two meta-trends: analytics depth and vertical specialization.

The absences are equally instructive. Kepion, a 2024 Leader, does not appear in the 2025 matrix, nor do Limelight Software, Syntellis, Centage, Acterys, Just Perform. Moreover, Oracle, a 2024 Leader, has also vanished in 2025. Absence can reflect a range of factors, from eligibility and evaluation windows to product focus shifts or slower momentum in the criteria that hardened between 2024 and 2025 (agentic AI in operations, reconciliations embedded in-platform, and demonstrable bi-directional integrations). For buyers, the practical takeaway is to press vendors on operational completeness and recent releases, not just on historical brand strength.

How 2024 Set the Stage and Why 2025 Feels Different

The 2024 Matrix marked a turning point by explicitly elevating account reconciliation as a core capability and treating rule-based automation and RPA as part of the planning product, not as bolt-ons. Customer service excellence, release cadence, enablement quality, and responsive support, also emerged as a differentiator because these factors determine whether continuous planning is sustainable beyond the pilot. Many of the vendors that rose in 2024 did so by delivering those operational competencies alongside strong modeling engines.

In 2025, those same competencies are table stakes. The market now rewards platforms that operate financial work with AI, not just inform it. That means anomaly detection that auto-routes exceptions, agent-written narratives that accelerate close, and scenario refreshes triggered by real-time signals from ERP and CRM systems. It also means bi-directional connectors that eliminate data hand-offs and drill-back paths that keep audits fast and confident. If 2024 was the year FP&A became closed-loop, 2025 is the year it became AI-operated and enterprise-grade.

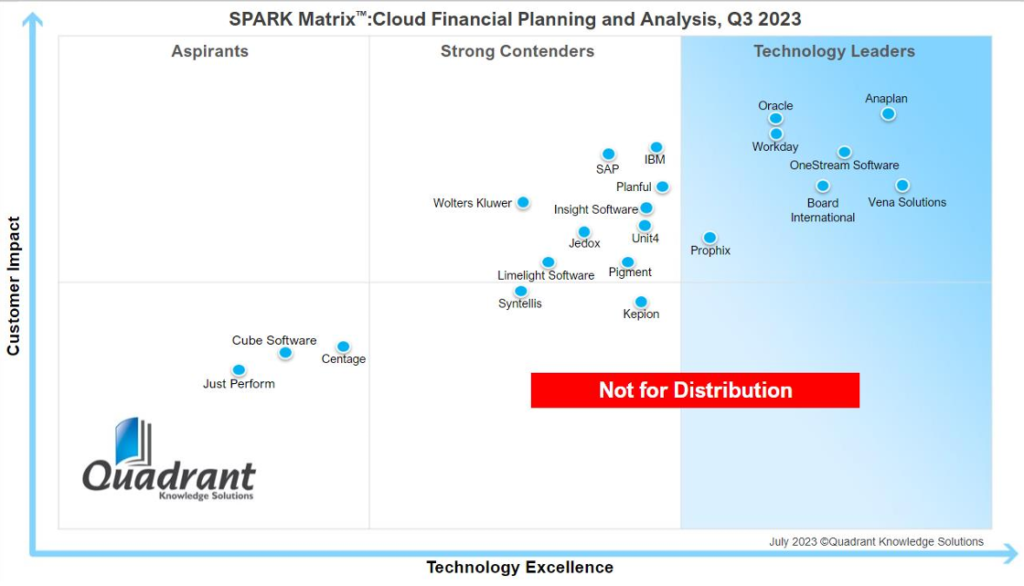

A Brief 2023 Baseline for Context

A quick look back helps clarify the arc. In 2023, the leadership roster leaned toward platforms known for modeling scale and connected planning, which includes Anaplan, Oracle, Workday, OneStream, Vena, Board, Prophix, while IBM, SAP, Planful, Wolters Kluwer, Insight Software, Unit4, Jedox, Pigment gathered in Strong Contenders. The conversation still centered on the benefits of cloud over on-premises and on AI-assisted forecasting. The subsequent two years layered in reconciliation, automation, and enablement, and made interoperability the non-negotiable bridge between planning and the operational core.

What Finance Leaders Should Do Next

The smart way to read the 2025 Matrix is to reuse your 2024 scorecard but re-weight it. Put agentic AI, reconciliation automation, and bi-directional integrations at the top; treat modeling engine benchmarks and visualizations as necessary but insufficient. If you are a SAP-anchored enterprise, its new leadership status argues for a serious look for Planning. furthermore, for a unified, close-to-plan governance on a single extensible model, OneStream remains compelling. If Excel-native productivity with tighter governance is the priority, Vena and now Datarails deserve head-to-head trials. Organizations with Workday ERP/HCM footprints should view Adaptive Planning as the natural extension of their data fabric, while Anaplan continues to be the archetype for cross-functional, connected planning at enterprise scale. Buyers in healthcare should not overlook Strata Decision Technology, and those favoring BI/OLAP heritage and broad ERP coverage should keep Insight Software in the mix.

The bottom line is that FP&A selection in 2025 is no longer about who can model the future most elegantly; it’s about who can run the finance operating loop most reliably, with AI doing real work, integrations staying live, and governance holding firm under pressure. Pick the vendor that proves all three in your environment, and you’ll feel the difference not just in forecast accuracy, but in the speed and confidence of every month-end that follows.

To know more: SPARK Matrix™: Cloud Financial Planning and Analysis, Q2 2025