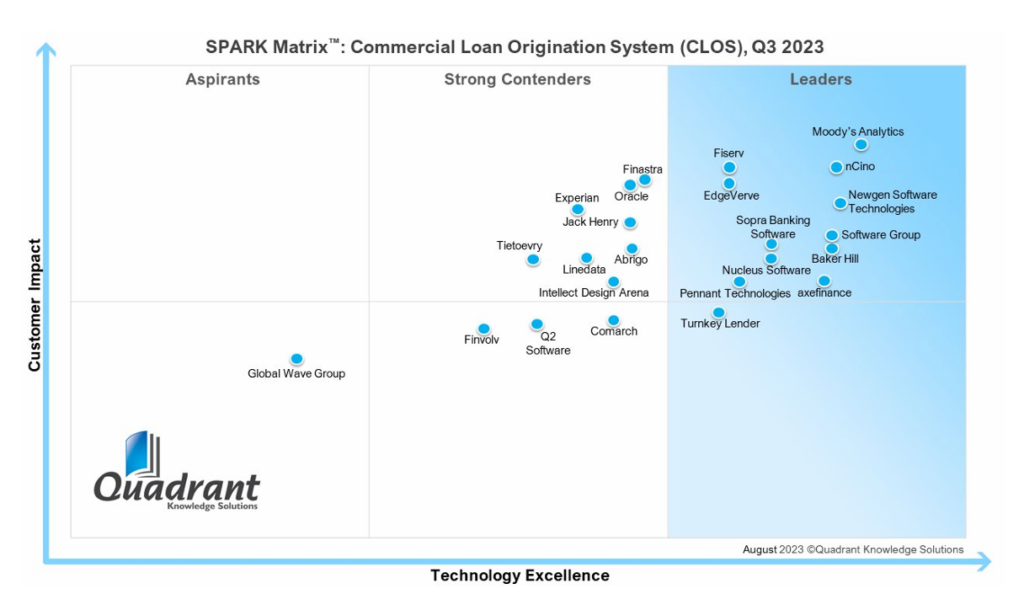

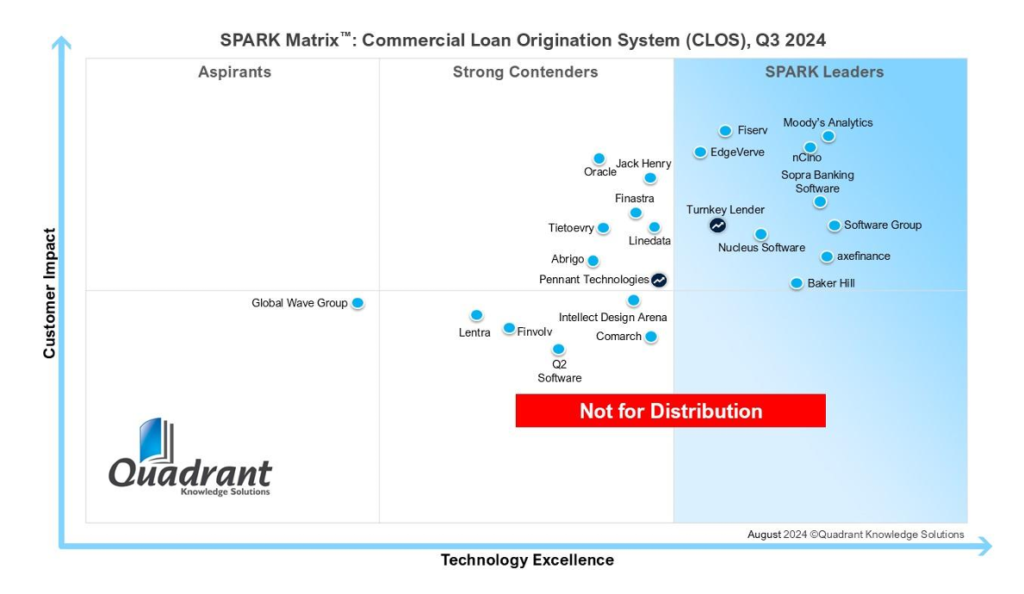

The commercial loan origination systems (CLOS) market has shifted sharply between 2023 and 2024. What was once a race for digitization has become a contest of orchestration: who can embed AI, automate decisioning, and interoperate at scale. The SPARK Matrix™ reflects this change by rewarding vendors that went beyond point-automation to deliver composable, AI-operated lending journeys with faster time-to-value.

In 2023, the market clustered around digital transformation basics: document management, automated spreading, and workflow automation. By 2024, leaders distinguished themselves by operationalizing AI models, building unified platforms, and moving to cloud-native microservices. Vendors that stagnated on legacy deployments saw their positioning decline, while those investing in low-code/no-code orchestration and integrated ecosystems moved up.

What the SPARK Matrix Measures

The SPARK Matrix™ benchmarks vendors along two axes:

- Technology Excellence

- Customer Impact

The 2024 criteria placed greater weight on operational AI, composability, and cloud-native architecture, explaining why some vendors advanced and others plateaued.

Top Trends in 2024

1. Operational AI moves from pilots to production.

In 2023, AI was largely discussed as an enhancement. By 2024, vendors such as Moody’s Analytics and nCino will have operationalized AI across credit scoring, automated pricing, and portfolio analytics. Moody’s CreditLens now applies AI to structured finance modeling, while nCino IQ integrates ML and OCR to automate financial statement analysis. This leap improved both accuracy and time-to-decision, directly lifting their Technology Excellence scores. Vendors that still treated AI as bolt-ons, however, saw limited movement.

2. Unified lending platforms drive orchestration.

Banks are tired of fragmented modules. In 2024, EdgeVerve’s Finacle and Baker Hill’s NextGen advanced because of their unified architecture, bringing origination, risk, and servicing under one workflow. These systems reduced handoffs and offered instant decisioning, which resonated with lenders under pressure to cut cycle times. Vendors that continued offering siloed modules without orchestration capabilities were penalized.

3. Cloud-native and microservices architecture wins.

The criteria shift favored platforms built on microservices for scalability and rapid updates. Fiserv, Nucleus Software, and TurnKey Lender gained ground here. Their SaaS-native deployments allowed banks to expand into new lending products quickly without heavy IT overhead. Those reliant on-premise or monolithic upgrades faced delays and stagnation, hurting their Technology Excellence rating.

4. Low-code/no-code becomes table stakes.

TurnKey Lender and Software Group are differentiated by offering low-code orchestration, letting banks customize workflows and integrate third-party apps visually. This accelerated time-to-value and reduced dependency on IT teams. By contrast, vendors with rigid platforms, even if functionally rich, struggled to meet banks’ demand for agility.

5. Customer experience shifts from digitization to personalization.

Sopra Banking Software and Finastra stood out for embedding predictive analytics into onboarding and risk assessment. Their platforms delivered personalized loan offers and omnichannel journeys, moving the conversation beyond “digital loan files” into “customer-centric origination.” This improved their Customer Impact ratings, especially in competitive SME and mid-market segments.

Vendor Position Analysis

Among Leaders, Moody’s Analytics, nCino, Fiserv, and EdgeVerve strengthened their positions. Moody’s leveraged analytics depth but must simplify deployment complexity to broaden mid-market adoption. nCino gained ground with its Bank Operating System yet faces challenges in document management fragmentation. Fiserv integrated seamlessly with servicing but must address customer concerns on support agility. EdgeVerve’s Finacle stood out for advanced workflows and emerging market wins, though multi-tenant scaling remains a work in progress.

Sopra Banking Software entered 2024 with modular AI-driven origination, gaining Leader visibility. Its challenge is sustaining performance outside Europe, where regional compliance demands differ. Finastra retained strong positioning by pushing open integration and risk management depth, but the firm must accelerate customer support scale in newer regions.

Challengers such as Baker Hill and Axefinance showed upward momentum. Baker Hill’s use of generative AI for credit memos resonated with regional banks, but a broader global reach is pending. Axefinance delivered dynamic scoring and omnichannel origination, though voice-activated features remain at an early stage. Jack Henry invested in AI models for credit assessment, but must better harmonize its user interface to keep pace with rivals.

Software Group and TurnKey Lender exemplify visionaries who have converted into stronger contenders. Their low-code platforms resonated with niche FIs seeking agility. Yet, both must prove resilience in high-volume corporate lending to sustain growth.

Notably, Oracle advanced due to deep cloud and database integration, offering regulatory automation and high scalability. However, customer perception of complexity in implementation keeps it from breaking further into mid-tier banks. Nucleus Software maintained a solid Leader position with FinnOne Neo, but must accelerate multi-region regulatory compliance capabilities to meet global standards.

The 2024 matrix also reflected exits and realignments. Some regional players consolidated or repositioned due to the inability to match AI maturity and composability expectations. Vendors relying purely on document management or legacy credit modules without orchestration features saw diminished impact.

What should be taken into consideration?

Buyers should prioritize vendors demonstrating operational AI, low-code orchestration, and unified platforms. Time-to-value is now determined by configurability and ecosystem readiness, not just core functions. Institutions must assess whether a vendor’s roadmap addresses both regulatory agility and customer personalization. Vendors must go beyond digitization and invest in composable architectures with AI embedded in credit decisioning, risk monitoring, and servicing. Partner ecosystems, not just product roadmaps, will define differentiation in 2025. Sustaining trust requires balancing automation with compliance and transparency.

According to Vvvd Akhilesh, Principal Analyst at QKS Group, “A Commercial Loan Origination System (CLOS) is a comprehensive software solution designed to streamline and manage the entire commercial lending process—from loan origination and processing to distribution and ongoing monitoring. Serving organizations of all sizes, CLOS typically includes modules for application generation, KYC processing, underwriting, documentation, loan servicing, and delinquency management. By offering an end-to-end solution, CLOS enables organizations to boost revenue, manage risk effectively, enhance operational efficiency, and deliver a seamless customer experience throughout the lending lifecycle.”

Conclusion

The definition of leadership in commercial loan origination has been rewritten. In 2024, it is not enough to digitize loan files; true leaders operationalize AI, orchestrate workflows, and scale through composable, cloud-native platforms. The next frontier will reward those who turn compliance pressure into competitive advantage and deliver lending as a seamless, intelligent service.