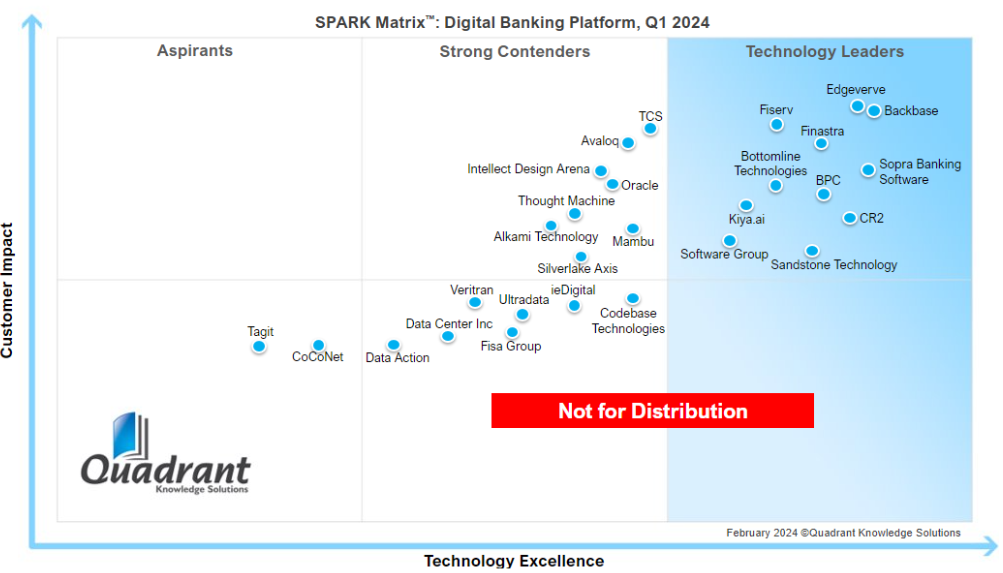

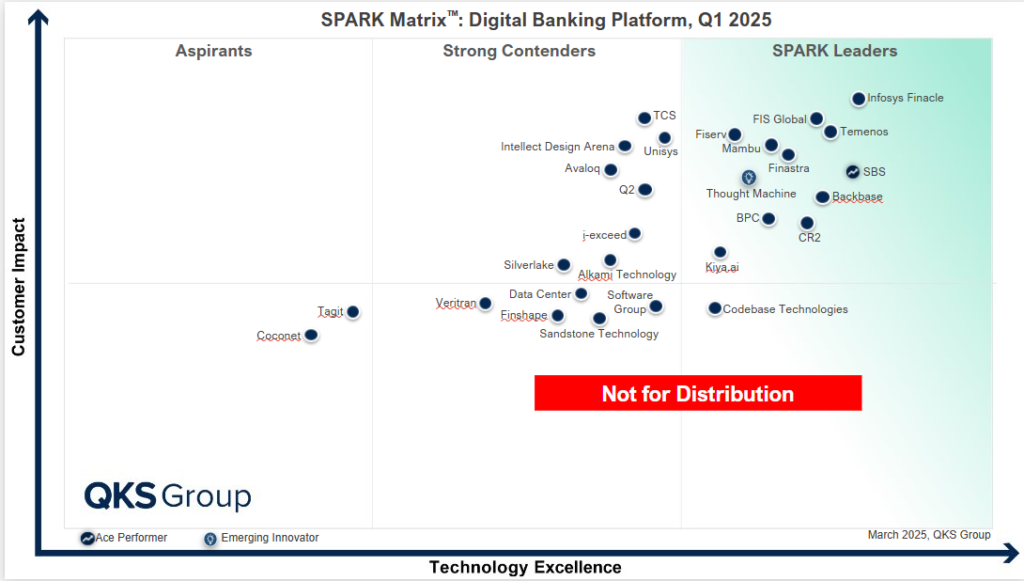

In the evolving world of digital banking platforms, the gap between front-end channel modernization and true platform transformation is growing. The SPARK Matrix™ for Digital Banking Platforms 2025 highlights leaders in banking technology, contenders, and the impact of innovation inertia. This blog gives a comprehensive year-on-year comparison of the 2024 and 2025 SPARK Matrix reports. It also unpacks how and why vendors moved, and what it means for the broader market.

What is the SPARK Matrix?

Developed by QKS Group, the SPARK Matrix™ evaluates digital banking platform vendors based on two essential dimensions:

- Technology Excellence

- Customer Impact.

The matrix offers a strategic perspective by combining quantitative and qualitative assessments. It ranges from API maturity and omnichannel delivery to implementation agility and market penetration. It serves as both a benchmarking tool for banks and a strategic feedback loop for vendors seeking to align with future-facing digital banking expectations.

Market Trends: What’s Driving the Change in 2025?

In 2025, the market saw an accelerated shift toward cloud-native platforms with embedded intelligence, as financial institutions sought solutions beyond omnichannel delivery. Composability emerged as a foundational capability, enabling banks to tailor modular architectures around evolving business models. Embedded finance continued to redefine what a digital bank could offer, while real-time data orchestration, API-first ecosystems, and AI-driven personalization became essential, not optional, criteria for platform evaluation. These macro shifts set the stage for dramatic realignments in the SPARK Matrix this year.

Who Climbed, Who Stayed, and Who Dropped?

The 2025 SPARK Matrix introduced Infosys Finacle and Temenos into the upper leader quadrant. Neither had appeared in the 2024 matrix. Both vendors exemplified platform-centric innovation with mature core modernization offerings, seamless fintech integration, and strategic global partnerships. Infosys Finacle’s ability to drive composable transformation through a cloud-native, AI-augmented architecture made it a standout, particularly in APAC and MEA regions. Temenos, meanwhile, advanced through its sustained investments in banking functionality, extensibility, and cross-border composability. Their rise signals a renewed market appetite for core-to-experience platforms, rather than front-end-only digital veneers.

Thought Machine, which was a high-performing contender in 2024, ascended to leadership in 2025. This was driven by increased enterprise adoption of its Vault Core platform and a differentiated composable framework that offered unmatched flexibility, particularly for digital-native banks and neobanks seeking to build around microservices from the ground up.

Codebase Technologies, a 2024 lower-tier contender, also broke into the leadership quadrant, specifically in the lower leadership tier. The vendor gained traction through its blend of low-code orchestration, regional product-market fit (particularly in MENA), and readiness to serve Islamic banking models. It gained appeal among mid-sized banks seeking digital transformation without heavy reliance on in-house developers.

Several vendors maintained their leader positions with strong momentum. Fiserv, Finastra, SBS (Sopra Banking Software), BPC, CR2, Backbase, and Kiya.ai all preserved their leadership status, building on prior-year investments. Fiserv’s Architect™ and XD platforms continued to offer modular extensibility backed by an API-rich environment and proven global delivery. Finastra enhanced its position by doubling down on embedded finance and open ecosystem banking. SBS expanded its footprint in MEA and Europe with a scalable, composable suite, and BPC leveraged its transaction-focused backbone to deliver strong omnichannel capabilities. CR2, now part of HPS, benefited from synergy across digital banking and payments. Backbase strengthened its leadership through front-end orchestration, while Kiya.ai reinforced its standing in BFSI-centric markets with a clear cloud-first roadmap.

However, not every leader from 2024 retained their position. Bottomline Technologies, once a recognized leader, exited the matrix altogether in 2025. This likely reflects an internal product focus shift, organizational restructuring, or reduced activity in core digital banking innovation as the company pivots more toward treasury and payment orchestration. Meanwhile, Sandstone Technology and Software Group, both previous leaders, slipped into the lower contender quadrant in 2025. Their repositioning suggests challenges around composability, AI readiness, or market expansion, particularly as customer expectations have advanced from basic channel digitization to full-stack ecosystem enablement.

Who’s Gaining, Who’s Drifting, and Who’s Debuting?

The upper contender quadrant remained dynamic in 2025, with some vendors sustaining strong momentum, others stagnating, and a few making their debut.

Alkami Technologies remained an upper-tier contender across both years. Its platform excels in omnichannel UX, cloud-native scale, and fintech partnerships, especially for U.S. credit unions and community banks. But its limited international presence continues to cap its Customer Impact score. The vendor’s deep integration ecosystem and behavioral personalization have kept it relevant. But a broader market appeal is required for a leap into leadership.

Mambu, Intellect Design Arena, Avaloq, and TCS also held steady in the upper contender tier. Each brings strong core capabilities: Mambu through its composable core, Intellect with enterprise-ready breadth, Avaloq in private banking, and TCS with strong implementation scale. However, slow innovation in AI, limited composable middleware, or platform complexity held these players back from elevating into leadership.

Notably, 2025 saw the entry of Unisys, Q2, and i-exceed into the upper contender quadrant. Unisys appears to be re-establishing its digital identity with security-forward capabilities. Q2 leveraged its community banking expertise and fintech integrations to gain traction in North America. I-exceed, through its Appzillon platform, demonstrated strong API extensibility and omnichannel maturity for banks in Asia-Pacific and Africa.

In the lower contender quadrant, the shifts were more sobering. Software Group, Veritran, and Data Center Inc., all of whom had higher standing in 2024, now occupy lower positions. The drop reflects lagging capability modernization, especially around composable APIs, data unification, and support for real-time financial services. New additions like Finshape were also placed here, as their offerings cater to niche use cases rather than full-stack transformation.

Who Exited and Why?

The most notable exit was Bottomline Technologies, which did not appear in the 2025 matrix. Despite a historic presence in payments and treasury tech, Bottomline may have chosen to de-emphasize its digital banking platform segment. Or thinking of it, maybe it has consolidated its product focus. Similarly, FISA Group and Data Action, both lower-quadrant vendors in 2024, were removed in 2025. This could reflect failure to meet evaluation thresholds in technology readiness, regional relevance, or strategic vision alignment.

Still Trying to Break In

Tagit and Coconet continue to appear in the aspirant quadrant for the second year in a row. While both vendors demonstrate regional success and strong UI/UX capabilities, their platforms lack the scale, composability, and partner ecosystems necessary to rise into contender status. Continued investment in developer ecosystems, cloud-native services, and composable banking APIs will be critical for future movement.

The Final Take

The SPARK Matrix for Digital Banking Platforms 2025 reinforces one key message: leadership is earned, not inherited. In a market where banks are no longer just digitizing services but rethinking their role in digital ecosystems, vendor capabilities must go beyond omnichannel delivery to embrace platform thinking.

The vendors that have risen, Finacle, Temenos, and Thought Machine, are doing so by delivering modular, AI-native, and cloud-first platforms that are built for ecosystem orchestration, not just internal workflows. Vendors that remained static or dropped often lacked the agility to evolve or failed to anticipate the next wave of banking innovation.

As composable banking moves from concept to standard, and embedded finance shapes new customer experiences, the SPARK Matrix continues to be a crucial guidepost, not just for vendor benchmarking, but for strategic banking transformation itself.

According to Vvvd Akhilesh, Sr. Analyst at QKS Group, “The Digital Banking Platform landscape is undergoing a profound transformation, driven by API-first, cloud-native architectures that enable seamless integration, agility, and embedded finance. The next wave of innovation lies in AI-powered hyper-personalization, predictive analytics, and real-time fraud intelligence empowering banks to anticipate customer needs and mitigate risk proactively. At the same time, advanced biometrics, decentralized identity, and zero-trust frameworks are reshaping authentication, ensuring security without sacrificing user experience. Leadership in this space hinges on an API-first strategy, real-time intelligence, and the ability to embed banking into broader digital journeys. The SPARK Matrix brings these differentiators to the forefront, empowering financial institutions to make informed, future-ready decisions.”