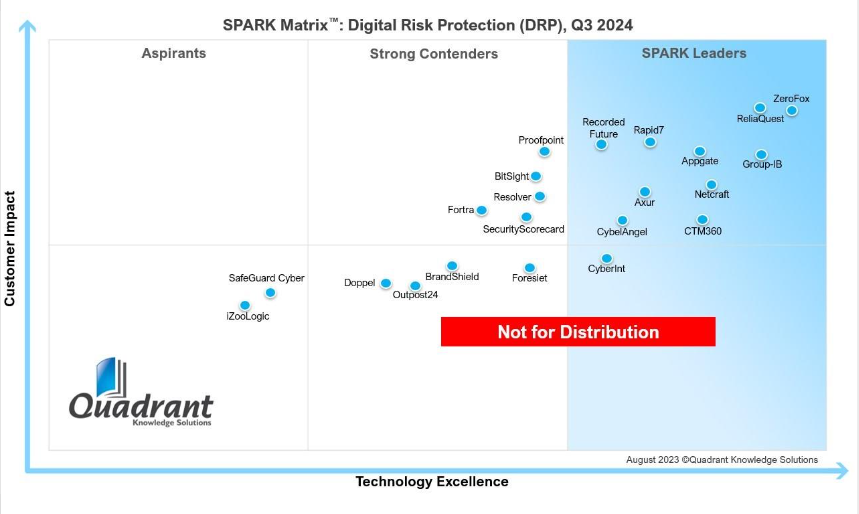

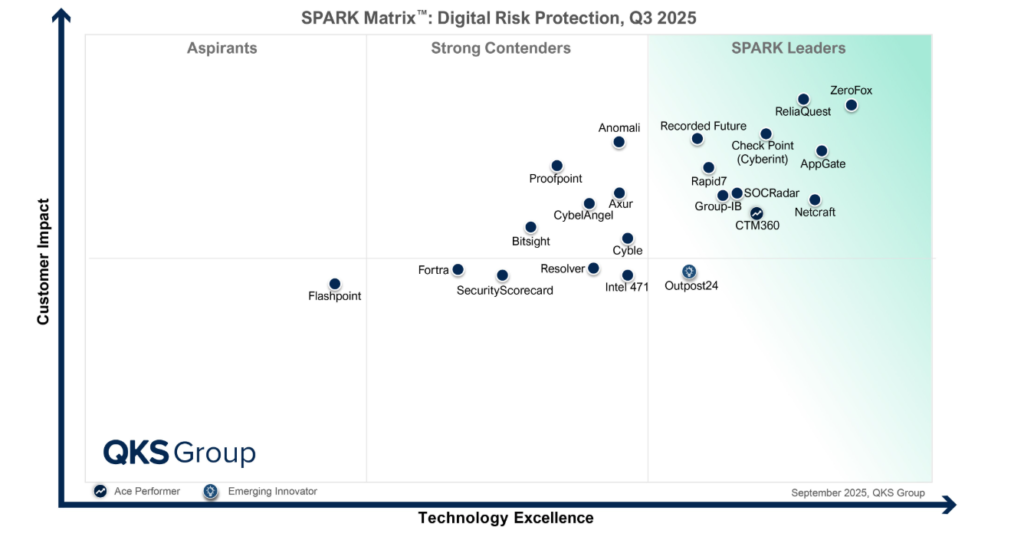

The Digital Risk Protection (DRP) landscape has matured sharply between 2024 and 2025, driven by buyers demanding unified external-risk visibility, faster takedowns, and deeper automation. The 2025 SPARK Matrix shows a market shifting decisively toward purpose-built DRP platforms rather than repackaged modules. The report also calls out a major structural shift: the vendors capable of continuously mapping external assets, correlating multi-surface signals, and executing rapid, in-house takedowns are the ones pulling ahead. At the same time, several long-standing players remain static, and a handful disappear altogether, illustrating how competitive and unforgiving this market has become.

According to Sahil Dhamgaye, Analyst at QKS Group, “As the Digital Risk Protection market matures, the need for comprehensive asset mapping has become increasingly urgent. Without a clear, continuously updated view of exposed digital assets, threat detection loses context and remediation slows down. This foundational capability is still missing or inconsistently addressed across many platforms. In parallel, there’s a shift toward in-house takedown operations, enabling faster, more accountable disruption of malicious assets which is a step that more vendors should adopt. Ultimately, the gap between vendors with dedicated DRP platforms and those repurposing capabilities from other products is widening. The future of DRP lies in treating it as a specialized, end-to-end function and not an add-on to existing security tooling.”

Who’s Evolving (The Movers & Shakers)

The most visible evolution in 2025 comes from the top of the matrix, where several vendors strengthen their leadership through technology expansion, operational maturity, or integrated risk-intelligence depth. Companies such as ZeroFox hold their leadership firmly by combining DRP, external attack-surface mapping, dark-web intelligence, and disruptions delivered through their Global Disruption Network. Meanwhile, ReliaQuest sustains its strong leadership by embedding DRP directly into its GreyMatter security operations platform, aligning external identity, credential, brand, and infrastructure signals with SIEM, EDR, and cloud telemetry.

The global intelligence giant Group-IB continues to excel by synchronising Digital Crime Resistance Centers, anti-fraud capabilities, scam-takedown intelligence, and actor-centric investigations. Similarly, AppGate (shown as Appgate in 2024 and AppGate in 2025) remains a leader because of its unified fraud-centric DRP offering, which integrates identity protection with phishing, brand-impersonation monitoring, and transactional-risk analytics.

Among disruption-driven leaders, Netcraft continues to dominate with its unmatched takedown speeds and global provider relationships, while Recorded Future maintains its leadership by unifying DRP with its broader Intelligence Cloud and Intelligence Graph across brand, payment, and credential-leak intelligence. Rapid7 stays positioned as a practical leader because Threat Command integrates DRP with ASM, MDR, and incident-response workflows, enabling SecOps teams to treat external threats as part of the core detection pipeline.

The year’s most significant upward momentum is seen with CTM360 and SOCRadar. CTM360 strengthens its leadership with a fully SaaS model requiring no installation, unlimited takedowns, an autonomous external asset engine, and 24×7 global incident response. SOCRadar, a new leader in 2025, rises through its unified XTI platform that merges DRP, EASM, cyber-threat intelligence, and supply-chain monitoring into a single operational fabric, supported by its internal takedown engine and deep dark-web coverage.

A particularly notable shift is the transformation of CyberInt into Check Point (Cyberint) after its integration into Check Point’s security platform. This combined offering enters directly into the Leaders quadrant, blending the Argos DRP platform with ThreatCloud AI, PlayBlocks automation, and Check Point’s MDR services. Finally, Outpost24 moves from Strong Contender in 2024 to the lower Leader quadrant in 2025, enabled by its Exposure Management Platform that unifies DRP, EASM, vulnerability management, and automated pentesting, creating an integrated risk surface few rivals match.

Who’s Stalling (The Static & Dropping)

Several vendors remain in the same quadrant year over year. ZeroFox, ReliaQuest, Group-IB, AppGate, Netcraft, Recorded Future, Rapid7, and CTM360 all stay in the Leaders quadrant, although the competitive pressure rises now that SOCRadar and Outpost24 have joined them. In the Strong Contender category, Proofpoint retains its position, still focusing on identity-centric DRP linked heavily to email, ATO protection, and social-media monitoring, though without a fully centralised DRP architecture. BitSight continues to prioritise ratings and exposure intelligence, maintaining a stable position but still short of automated takedown orchestration.

Meanwhile, Resolver remains a Strong Contender thanks to its horizon-scanning and online-risk insights, and Fortra, building on PhishLabs’ lineage, remains steady but continues to lean on manual workflows that limit scale. SecurityScorecard also stays in the Strong Contenders quadrant, benefiting from broad cyber-ratings and threat intelligence but still lacking the deeper automated remediation capabilities found among the top leaders.

Two vendors experience downward movement in 2025. Axur falls from Leader to Strong Contender as the report points to uneven global takedown efficiency and more region-specific datasets. CybelAngel also moves down from Leader to Strong Contender due to reliance on manual validation and limitations in autonomous remediation workflows.

The Changing Guard (Entries & Exits)

The 2025 matrix introduces several new names that reshape competitive dynamics. Anomali emerges as a Strong Contender, fusing DRP into the broader Anomali Platform and ThreatStream while offering integrated takedown services. Cyble enters with an AI-driven DRP+CTI model targeting government, BFSI, and critical-infrastructure clients. Intel 471 joins via its closed-source intelligence expertise, specialising in credential marketplaces, malware logs, and cybercrime forums. Flashpoint strengthens the category by tying cyber, fraud, physical, and geopolitical intelligence into actionable DRP use cases.

The two most disruptive entrants sit in the Leaders quadrant: SOCRadar and Check Point (Cyberint), both of which fundamentally raise the bar for unified DRP, takedown automation, and cross-surface intelligence.

At the same time, several vendors disappeared from the matrix entirely. SafeGuard Cyber and iZoologic, both previously Aspirants, exit the 2025 landscape. Doppel, BrandShield, and Foresight also drop out after being in the Strong Contenders segment in 2024. The standalone brand CyberInt exists as well, but reappears as part of Check Point’s integrated offering.

Why It Matters (The “So What” for Buyers)

The year-on-year shifts make it clear that the DRP category is evolving beyond basic monitoring into a multi-layered discipline that forces organisations to unify brand protection, identity protection, dark-web intelligence, external asset discovery, and fraud-linked threat analysis. The 2025 report repeatedly stresses that buyers should prioritise vendors capable of autonomous asset mapping, something players like Outpost24, CTM360, SOCRadar, Netcraft, ZeroFox, ReliaQuest, and Recorded Future do noticeably well. The leaders now deliver native takedown engines rather than relying on public reporting channels, reducing exposure time and containing financial, reputational, and operational impact.

AI has shifted from cosmetic GenAI chat interfaces to genuine machine-learning orchestration. Vendors such as CTM360, SOCRadar, Netcraft, Outpost24, Recorded Future, ReliaQuest, Rapid7, Intel 471, Cyble, Flashpoint, and Group-IB now apply AI and ML to autonomous discovery, anomaly detection, prioritisation scoring, campaign clustering, and automated remediation routing. This shift matters for buyers because it shortens detection windows from days to hours, reshapes SOC workflows, and reduces manual overhead.

DRP is also converging with fraud intelligence and financial crime detection. Vendors like AppGate, Flashpoint, Intel 471, Group-IB, Cyble, and Recorded Future show deep capabilities in transactional-risk analytics, scam detection, underground-market infiltration, payment-fraud intelligence, and actor-centric profiling. For CIOs, CISOs, and CFOs, this means DRP must now be evaluated alongside threat-intel, fraud, brand-risk, identity-intelligence, and supply-chain-risk budgets, not as an isolated cybersecurity add-on.

Conclusion

The 2024–2025 comparison reveals a market that is maturing rapidly and rewarding vendors who innovate, consolidate capabilities, and deliver measurable operational impact. Outpost24, SOCRadar, and Check Point (Cyberint) join the leaders, while established players such as ZeroFox, ReliaQuest, Group-IB, AppGate, Netcraft, Recorded Future, Rapid7, and CTM360 hold strong positions. Axur and CybelAngel move down. Proofpoint, BitSight, Resolver, Fortra, and SecurityScorecard remain steady. New entrants, Anomali, Cyble, Intel 471, Flashpoint, SOCRadar, and Check Point (Cyberint), expand the competitive field. Departures, SafeGuard Cyber, iZoologic, Doppel, BrandShield, Foresight, and standalone CyberInt highlight the rising bar.

For enterprises navigating an increasingly volatile digital ecosystem, the takeaway is direct: choose DRP providers who can discover your assets continuously, detect threats proactively, disrupt malicious infrastructure quickly, and integrate seamlessly into your SecOps, GRC, and fraud-risk stack. As 2025 demonstrates, DRP is no longer a peripheral function; it is a foundational pillar of digital-trust resilience.