Governance, Risk, and Compliance (GRC) platforms have moved from being back-office control centers to becoming strategic intelligence layers across enterprises. What was once a compliance checklist has now evolved into a connected orchestration system, one that unifies enterprise risk, audit, cyber resilience, and ESG visibility.

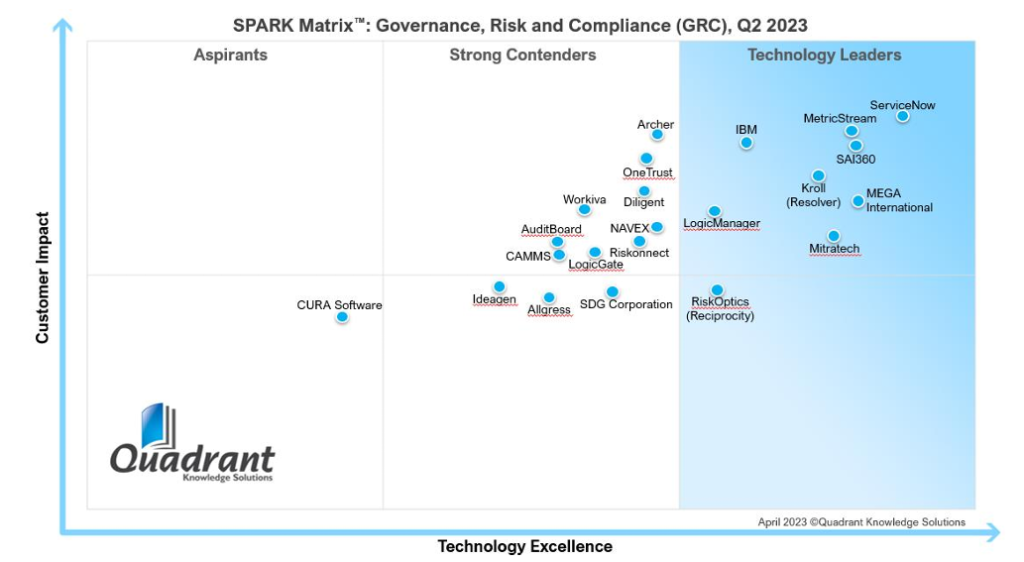

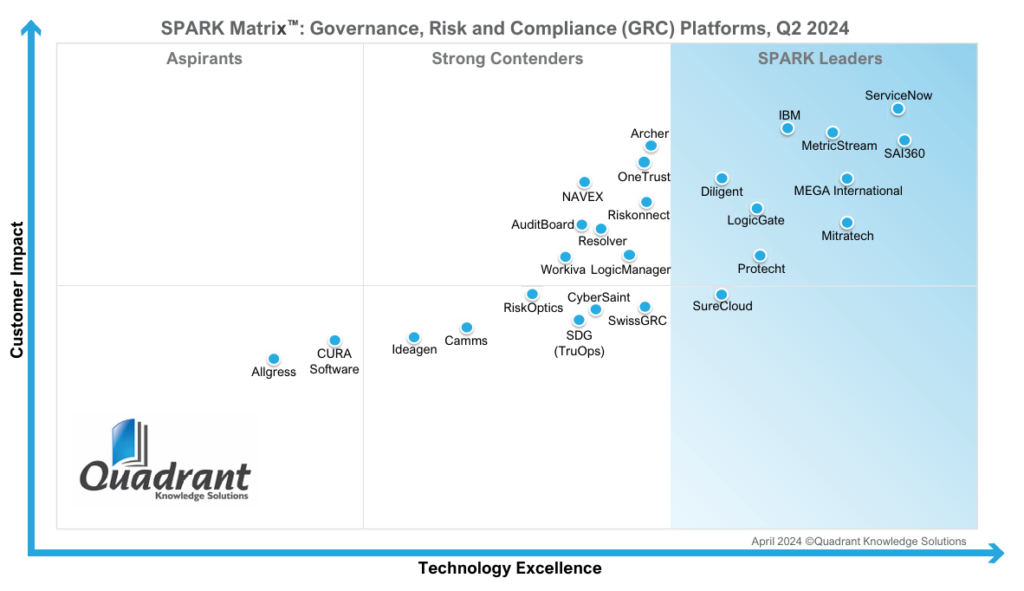

The SPARK Matrix™ for GRC Platforms, published by QKS Group, captures this transformation in sharp relief. A comparison of the 2023 and 2024 editions reveals a market reshaped by AI-driven risk analysis, cyber-risk quantification, and low-code automation. Some vendors consolidated their dominance, while others ascended rapidly by aligning their platforms with GenAI, ESG, and integrated risk orchestration. A few, however, lost ground as innovation fatigue set in.

What Is the SPARK Matrix™?

The SPARK Matrix evaluates vendors across two dimensions:

- Technology Excellence

- Customer Impact

Unlike static rankings, the Matrix is dynamic; it reflects how effectively each vendor is adapting to real-time enterprise challenges such as regulatory volatility, cyber-resilience, and ESG transparency.

Market Trends: What Changed Between 2023 and 2024?

1. From Integration to Orchestration

2023 was the year of platform consolidation. By 2024, orchestration had become the expectation, and enterprises demanded a single pane of glass across risk, audit, and compliance. Vendors that offered cohesive workflows, automation, and risk intelligence dashboards climbed the quadrant.

2. The GenAI Inflection Point

Artificial Intelligence evolved from a buzzword to business value. 2024 introduced GenAI copilots for regulatory interpretation, policy writing, and risk summarization. Vendors like SAI360 and Mitratech embedded conversational assistants; meanwhile, others are still experimenting.

3. Cyber & Third-Party Risk Convergence

IT risk management matured into cyber quantification and continuous third-party monitoring. Platforms with integrated threat intelligence (IBM, MetricStream) stood out for measurable risk reduction.

4. ESG Joins the Core Suite

Environmental, Social, and Governance modules, once optional, became expected, with ServiceNow, Diligent, and MetricStream integrating ESG data directly into risk dashboards.

5. UX and TCO Redefined the Buyer Lens

Ease of deployment, configurability, and cost transparency became decisive. Low-code configurability is now a winning differentiator, driving mid-tier platforms like LogicGate and SureCloud into leadership.

Leaders Quadrant

Consistent, Rising, and Declining

ServiceNow, MetricStream, IBM, SAI360, Mitratech, and MEGA International maintained their positions through sustained product investment and enterprise focus. ServiceNow reinforced its leadership by integrating ESG and IT-risk capabilities more deeply into its Now Platform ecosystem. MetricStream continued to stand out for its comprehensive compliance automation and strong analytics framework, demonstrating that enterprise maturity remains a strategic asset when coupled with modernization. IBM’s OpenPages combined scale with intelligence, leveraging the watsonx AI engine to deliver quantifiable insights on risk exposure. SAI360 advanced its GenAI assistant for compliance and policy management, underscoring its innovation-led roadmap. Mitratech consolidated its acquisitions of Alyne and ClusterSeven to offer a connected risk and resilience framework, while MEGA International sustained its European dominance through governance and data lineage visualization.

While these incumbents held firm, the spotlight in 2024 belonged to the new leaders: Protecht, LogicGate, SureCloud, and Diligent, each representing a different face of the modern GRC ecosystem. Protecht transformed its strong APAC presence into global relevance by combining cloud-native architecture with configurable workflows. LogicGate’s journey from contender to leader was powered by its intuitive design and modularity, which appealed to mid-market buyers seeking flexibility without complexity. SureCloud made its mark through AI-powered analytics and automated compliance workflows that deliver measurable time savings. Diligent, long known for board governance and ESG disclosure, completed its metamorphosis into a full-suite GRC player by integrating audit and compliance within the same digital spine.

The other side of the story belongs to those who lost altitude. Resolver (Kroll) and RiskOptics( rebranded as Zen GRC), both positioned as leaders in 2023, fell into the contender quadrant by 2024. Their retreat underscores how rapidly the market’s definition of leadership can shift. Slower adoption of AI, delayed cyber-risk roadmap execution, and limited ecosystem integration proved costly. LogicManager, while still respected for governance functionality, lost momentum amid the rise of agile, cloud-first competitors that deliver faster innovation cycles.

These shifts reveal a market in flux, one that rewards modernization speed, composability, and customer-centric design as much as functionality. The message is clear: leadership in GRC is no longer defined by history, but by the ability to continuously reinvent.

Contenders & Aspirants

Holding Ground, Waiting for Lift-Off

Below the top tier, the competitive landscape remained dense but stable. Vendors such as NAVEX, OneTrust, Riskonnect, AuditBoard, Archer, Ideagen, CURA, and Workiva continued to perform well in specialized domains but struggled to expand horizontally. Their strength lies in focus, whether it’s privacy, ethics, or audit excellence, yet the market’s gravitational pull favors integrated platforms capable of end-to-end orchestration.

Interestingly, 2024 introduced new coverage entrants such as CyberSaint and SwissGRC, signaling how regional and specialized innovation continues to enrich the ecosystem. CyberSaint’s focus on risk quantification and automation positioned it as a potential disruptor in IT-risk management, while SwissGRC’s emphasis on localized compliance and governance frameworks gave it strong resonance in EMEA markets. These new names, though not yet in the leadership quadrant, represent the next generation of challengers in the GRC continuum.

Exits and New Entrants

The churn between 2023 and 2024 offers one of the most compelling indicators of the market’s maturity. The exit of Resolver and RiskOptics from the top tier serves as a cautionary tale: legacy prominence cannot compensate for delayed innovation. Their repositioning into the contender category demonstrates how the SPARK Matrix rewards tangible progress over past performance.

Conversely, the entry of Protecht, LogicGate, SureCloud, and Diligent into the leaders quadrant illustrates a democratization of innovation. The barriers to entry for global visibility have lowered. It’s not because competition is weaker, but because nimble, SaaS-first vendors can now achieve enterprise-scale functionality faster. This dynamic ensures that GRC leadership remains meritocratic. It must be earned every year through modernization, ecosystem strength, and measurable customer impact.

The Rise of Orchestrated Risk Intelligence

The year-on-year findings confirm that GRC platforms are entering a new era of intelligence. The traditional model, built around static compliance checklists, is being replaced by dynamic systems that can interpret, learn, and act. The leaders of 2024 share one defining trait: they have embedded reasoning into risk. GenAI is no longer an experiment; it’s the operational core. AI-generated policies, contextual risk summaries, and predictive compliance dashboards have turned once-manual tasks into automated insights.

This transformation also redefines the buyer mindset. Organizations are no longer looking for “GRC tools”; they’re looking for resilience platforms. These solutions don’t just document compliance; they demonstrate it, continuously and transparently. The convergence of cyber, ESG, and third-party management further cements GRC’s role as the enterprise’s nervous system, sensing, responding, and adapting in real time.

According to Sahil Dhamgaye, Senior Analyst at QKS Group, “The future of GRC will be characterized by increased regulatory scrutiny, evolving technologies, and complex global business landscapes. Organizations must adapt by leveraging advanced technologies such as AI and analytics for better risk management, and focus on developing a strong risk culture and proactive approach to compliance. Increased collaboration between departments and integration of GRC processes will be crucial. Additionally, organizations should invest in talent and training to build a workforce equipped to handle emerging risks. Staying ahead will require a holistic approach, integrating GRC into the core of business strategies to ensure long-term resilience and competitive advantage.”

Conclusion: What Buyers and Vendors Should Learn

For buyers, vendor evaluation must now focus on orchestration maturity, the ability to connect controls, data, and AI to deliver actionable intelligence. GRC tools that remain siloed or lack GenAI augmentation will struggle to justify enterprise-level investments. For vendors, the message is clear: composability, AI integration, and low-code accessibility will define the next quadrant. The GRC market is moving toward perpetual compliance, where governance is continuous and predictive, not reactive.

In essence, 2024 marked the moment when GRC stopped being an obligation and became an opportunity. The vendors that recognized this shift are not just managing compliance; they are redefining enterprise resilience itself.

Leadership in GRC isn’t inherited; it’s orchestrated.