Digital identity is no longer just a compliance requirement; it’s a competitive differentiator. From remote onboarding and KYC to fraud prevention and AI risk scoring, Identity Capture and Verification (ICV) has moved from being a security layer to a full-fledged orchestration hub for modern enterprises.

In a market shaped by regulatory overhaul, deepfake threats, and user experience demands, the Q2 2025 SPARK Matrix™ by QKS Group reveals just how fast vendors have had to adapt. The 2024 Matrix established a foundation where biometric matching, document validation, and facial liveness detection were considered differentiators. By 2025, those features are table stakes.

The new benchmark? Real-time orchestration, privacy-preserving identity, decentralized credentials, and global interoperability. In short, identity is no longer about proving who you are. It’s about doing so, instantly, seamlessly, and securely, on any channel, anywhere in the world.

A Quick Refresher: What the SPARK Matrix™ Measures and Why It Matters

The SPARK Matrix™ by QKS Group benchmarks technology providers on two axes: Technology Excellence and Customer Impact. It offers a dynamic quadrant view of vendors based on their innovation, adoption, product strategy, and overall customer experience. Unlike static rankings, SPARK Matrix captures market momentum, showing who’s leading, rising, plateauing, or falling behind.

This blog compares the 2024 and 2025 SPARK Matrix for ICV to uncover not just positional changes, but strategic shifts that led to those moves. For buyers, it’s a crystal-clear view of how the market is evolving, and which vendors are evolving with it.

The Leaders: Expanding the Definition of Digital Identity

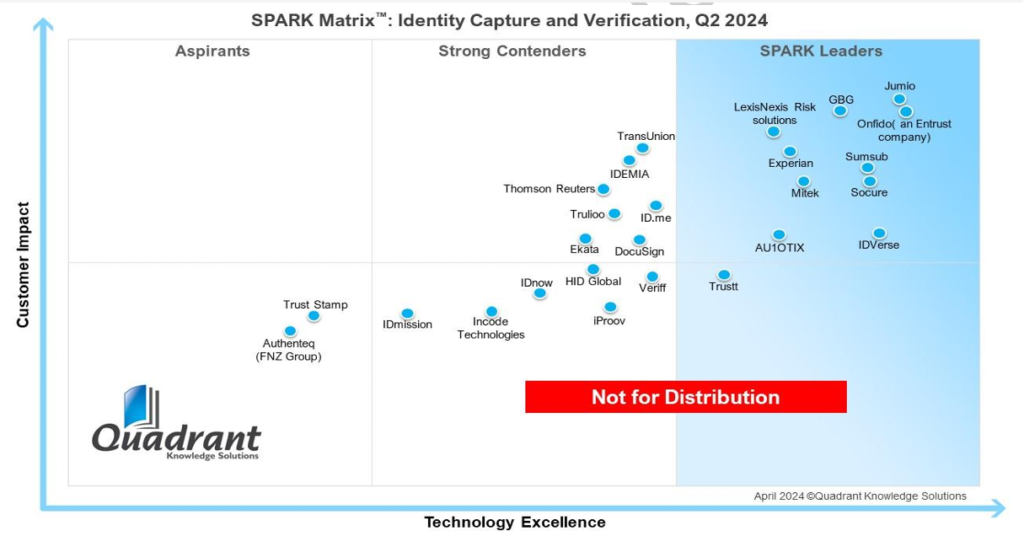

In 2024, the Leaders quadrant featured established names like Jumio, GBG, Onfido (Entrust), LexisNexis Risk Solutions, Sumsub, Socure, and Mitek, each offering strong biometric and document verification capabilities. Others like AU10TIX and IDVerse held mid-quadrant ground with AI-driven automation and flexible deployment options.

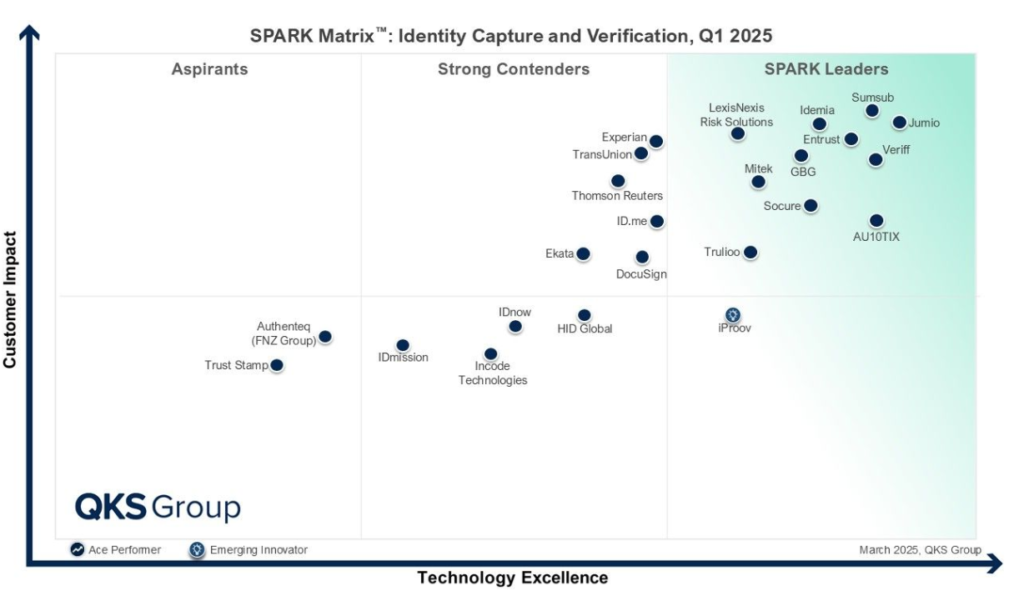

Fast forward to 2025, and the top-right quadrant has not only grown but transformed. Entrust (via Onfido) surged in strategic impact, propelled by centralized orchestration, privacy-preserving architectures, and stronger AML/KYC integration. Veriff, which was a Contender in 2024, leapt into the Leadership quadrant by investing heavily in anti-deepfake tech, multimodal biometrics, and compliance orchestration.

IDEMIA, previously in the Contenders, climbed into the Leadership quadrant in 2025, driven by improved biometric fidelity and government partnerships that made its platform more scalable for regulated sectors. Similarly, Trulioo made a decisive jump from Contender to Leader, reflecting its continued expansion of document coverage, fraud prevention toolkits, and low-code APIs that suit fintech and enterprise customers alike.

Interestingly, Iproov, once positioned among the Contenders, climbed into the Leaders’ quadrant in 2025. The move is attributed to its strategic push into high-security identity assurance with biometric liveness analytics and deep network defense capabilities.

The collective takeaway? Leadership in 2025 means more than verification. It means orchestration, resilience, and regulatory foresight.

The Contenders: Holding Ground or Losing Momentum?

The Contenders quadrant in both years has remained relatively dense, but the stories within it have shifted.

Vendors like Experian, TransUnion, ID.me, Ekata, and Thomson Reuters continue to feature in this group in both 2024 and 2025. While each brings specific strengths, ranging from data breadth to credit-linkage and identity correlation, their slow adoption of next-gen capabilities such as zero-knowledge proofing or dynamic fraud analytics may explain the lack of upward movement.

IDnow and HID Global, though retaining their Contender positions, appear to have plateaued. While strong in regional markets or hardware-led segments, these platforms have yet to demonstrate the agility or privacy leadership that’s now expected.

DocuSign also remains in the Contender segment across both years. Despite its integration value in eSignature and workflow automation, its identity verification capabilities haven’t shown enough market differentiation to justify quadrant elevation.

It’s worth noting that GBG, which was a Leader in 2024, moved slightly within the quadrant in 2025, still a Leader but not among the top few. The shift might reflect rising competition or stagnation in roadmap execution, though its core capabilities remain robust.

The Risers: Turning Vision into Execution

What differentiates a vendor that merely sustains a position from one that ascends the Matrix?

Veriff’s climb from Contender to Leader offers a strong case study. Their investments in deepfake detection, global coverage, and user-centricSDKs enabled real-time, secure identity verification across high-risk industries. Similarly, Trulioo’s leap reflects its success in turning platform extensibility and global document support into strategic differentiation.

IDEMIA, often seen as a government-focused vendor, proved in 2025 that its biometrics, now paired with orchestration tools and AML integrations, could meet private sector demands at scale.

These risers all shared one thing: a willingness to evolve from standalone features to comprehensive, orchestrated identity platforms.

The Non-Movers and Sliders: When Good Isn’t Good Enough

Vendors like Trustt and IDVerse were notably absent from the 2025 Leaders quadrant. Whether due to non-participation, product gaps, or shifting customer sentiment, their reduced visibility is telling.

Meanwhile, AU10TIX, which held a strong Leader position in 2024, saw moderate repositioning but remained within the top quadrant, highlighting continued customer impact but perhaps signaling a need for stronger privacy innovations and AI orchestration tools to stay competitive.

Among Contenders, iProov’s move upward into Leadership stood out, while others, like HID Global, IDmission, and Incode, held their 2024 spots but saw little strategic acceleration.

In the identity space, standing still is not the same as staying safe. Customers expect continual progress toward real-time intelligence, zero-data-exposure, and seamless onboarding.

The Omissions and Vanishing Acts

One of the most notable omissions in 2025 was Trustt, previously positioned in the Leader quadrant. Its absence could signal product de-prioritization, lack of momentum, or perhaps a shift in market focus. Similarly, IDVerse, ranked in the leadership tier in 2024, is missing from the latest study. Whether due to rebranding, restructuring, or strategy shift, their exclusion signals a gap in visibility or relevance.

On the other hand, no new vendors entered the SPARK Matrix™ 2025, suggesting that the market is consolidating around maturing players while maintaining high entry barriers for newcomers. This also reinforces the idea that competition is intensifying not at the edges, but at the top.

So, What Changed Between 2024 and 2025?

In one word? Expectations.

Where 2024 prioritized biometric strength and document intelligence, 2025 demanded composability, orchestration, and trust compliance. Platforms had to prove that they could scale across borders, resist adversarial threats like spoofing or deepfakes, and align with regulatory shifts like India’s DPDP or California’s CCPA.

What’s more, the definition of identity itself changed. It’s no longer a static credential to be verified; it’s a dynamic, risk-weighted trust signal that evolves in real time. Vendors who adapted to that paradigm leapfrogged ahead. Others simply didn’t.

Final Thoughts: Building Trust, Not Just Verification

The SPARK Matrix™ for Identity Capture and Verification is no longer just a positioning chart; it’s a reflection of how modern digital identity is being reimagined. The vendors who rose in 2025 did so by solving for speed, scale, security, and sovereignty. Those who stalled or disappeared did so by clinging to dated assumptions about what identity should do.

According to Vishal Jagasia, Senior Analyst at QKS Group, “Identity capture and verification solutions are real-time software applications that authenticate users by leveraging advanced liveness detection techniques, including biometric verification and facial recognition, to confirm individual authenticity. These solutions integrate data from government repositories and proprietary document databases to validate identities with high accuracy. By enhancing security frameworks, mitigating fraud risks, enabling personalized and automated onboarding experiences, safeguarding PII, ensuring compliance with regulatory mandates, and lowering operational costs, such platforms are becoming critical in modern digital identity ecosystems.”

If your organization is evaluating identity partners in this evolving landscape, the message is clear:

Choose platforms that don’t just verify who your users are, but help you trust them faster, safer, and smarter. Because in the age of digital trust, identity is the new infrastructure.