Digital identity is no longer just a gateway to customer onboarding; it’s a continuous process of building trust. As regulations tighten and fraud tactics grow more sophisticated, Know Your Customer (KYC) platforms are undergoing a seismic shift from point-in-time verification to perpetual, AI-powered risk intelligence.

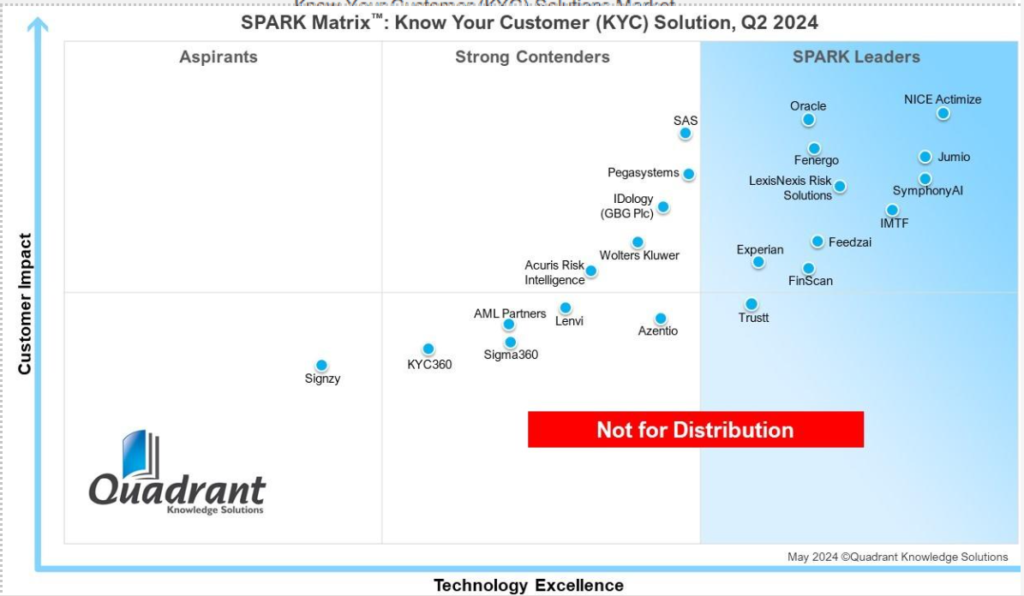

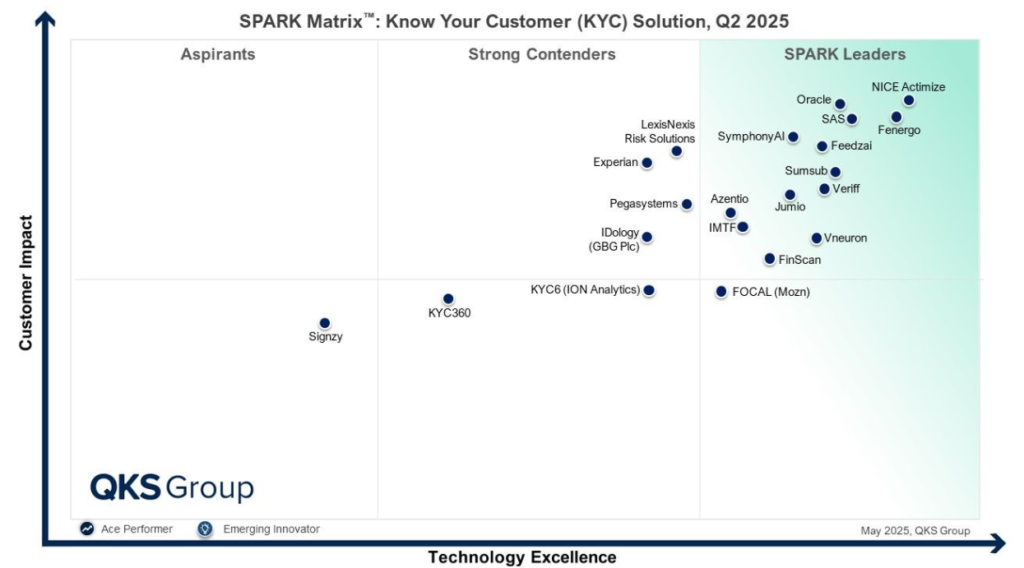

The SPARK Matrix 2025 for Know Your Customer (KYC), published by QKS Group, highlights the most significant vendor movements, strategic advancements, and innovation gaps in comparison to the 2024 edition. This year-on-year analysis uncovers which platforms have advanced, stagnated, or exited, and why the KYC market is now being reshaped by orchestration, explainable AI (XAI), and perpetual KYC (pKYC).

What is the SPARK Matrix and Why It Matters in the KYC Market?

Developed by QKS Group, the SPARK Matrix evaluates KYC technology providers across two strategic dimensions:

- Technology Excellence

- Customer Impact

It factors in over 25+ criteria ranging from AML integration, modular deployment, sanctions, and PEP screening to risk-based decisioning, AI explainability, and automation scalability.

Rather than a static leaderboard, the SPARK Matrix reflects real-time market relevance. It’s used by compliance leaders, financial institutions, fintechs, and regulators to benchmark vendor maturity and roadmap alignment.

Market Trends Shaping the KYC Space in 2025

Between 2024 and 2025, the KYC landscape has evolved from being document-centric to intelligence-centric. The most influential market trends include:

- AI-Augmented Risk Scoring: Vendors are adopting explainable AI to detect fraud patterns and reduce false positives.

- Perpetual KYC (pKYC): Event-driven monitoring is replacing periodic re-checks, improving compliance agility.

- End-to-End Orchestration: Platforms that integrate onboarding, due diligence, and continuous risk profiling into a unified workflow are emerging as category leaders.

- AML-KYC Fusion: Vendors are consolidating capabilities across financial crime detection, sanctions screening, and identity verification.

- Low-Code Case Management: Embedded investigations, audit trails, and SAR filing tools are now table stakes.

- Regional Compliance Agility: Multi-jurisdictional support, particularly for regions like MENA, APAC, and Latin America, is a major differentiator.

These shifts have significantly influenced the 2025 SPARK Matrix positioning.

The Leaders: Rising Stars and Steady Performers

The 2025 Leaders quadrant saw multiple shifts, with some new powerhouses joining the ranks and others strengthening their foothold.

Sumsub, absent in 2024, entered the Leader quadrant in 2025 with force. Its platform’s ability to deliver real-time onboarding, adaptive risk scoring, AML checks, and biometric verification, especially for crypto and fintech sectors, catapulted it ahead of many legacy vendors.

Veriff, also missing in the 2024 matrix, now appears in the Leaders tier. With a focus on multimodal biometrics, deepfake detection, and SDK-based onboarding, Veriff has positioned itself as a security-first KYC leader with scalable performance in digital-first industries.

SAS, a former Contender in 2024, climbed into the Leader quadrant in 2025. The move was powered by its data science legacy, integrated case management, and enhanced AI/ML tooling for AML-KYC convergence.

Meanwhile, existing Leaders such as Nice Actimize, Oracle, Fenergo, Feedzai, SymphonyAI, Jumio, IMTF, Finscan, and Vneuron retained their leadership status across both years. These vendors maintained consistent investments in explainable AI, cross-border compliance support, onboarding orchestration, and modular API-based deployments. Their ability to integrate KYC into broader fraud management and compliance ecosystems has reinforced their staying power.

Azentio, which was in the lower Contender quadrant in 2024, leaped into the Leadership tier in 2025. This rise reflects improved support for banking-specific KYC processes in the Middle East and Asia-Pacific, and stronger pKYC workflows.

The Contenders: Holding Ground or Losing Momentum

In the 2025 Contenders quadrant, we see a mix of stability and strategic regression.

LexisNexis Risk Solutions, once a Leader in 2024, slipped into the Contenders tier in 2025. While still strong in data aggregation and identity analytics, the vendor’s slower innovation in orchestration, GenAI explainability, and global reach limited its trajectory.

Experian, which was also a Leader in 2024, remained a Contender in 2025. Though known for its breadth of identity and credit data, the platform continues to lag in modular orchestration, explainable ML, and advanced biometrics.

IDology (GBG Plc) held its Contender status across both years. It remains a solid choice for North American markets, but lacks the global configurability and pKYC intelligence of some of its rising competitors.

Pega Systems, with its powerful business rule engine, retained its Contender placement. However, limited KYC-specific innovations, lack of embedded AML integration, and complex deployment models have slowed its upward momentum.

Lower Contenders and Aspirants: Slipping or Stagnant

The Lower Contender quadrant in 2025 features KYC6 (ION Analytics) and KYC360 (KYC Global Technologies), both of whom were similarly placed in 2024. Despite strong research-driven EDD (Enhanced Due Diligence) and niche regulatory strengths, these platforms are falling behind in automation, GenAI adoption, and onboarding speed.

Signzy, which continues to appear in the Aspirants quadrant for a second year, demonstrates strong potential in the Indian market. However, the lack of a global footprint, case management tooling, and enterprise-grade orchestration features has stalled its growth trajectory.

Who Dropped, Who Exited and Why?

Several notable vendors dropped out of the 2025 Matrix entirely:

- Trustt, positioned in the lower Leader quadrant in 2024, is missing in 2025. Possible reasons include product de-prioritization, internal restructuring, or failure to meet new benchmark criteria like AI transparency and orchestration depth.

- Wolters Kluwer, AML Partners, Sigma360, Lenvi, and DocuSign, all previously in the Contenders and lower Contenders tiers, were also excluded in 2025. Their exits signal market pressure to evolve beyond rule-based verification toward intelligence-driven, scalable KYC operations.

New Entries: Who Debuted in 2025?

A key new entrant in 2025 is Focal (Mozn), now appearing in the Lower Leader quadrant. With a strong focus on the MENA region, regulatory alignment, and watchlist screening, Mozn is quickly gaining ground as a regional challenger with aspirations of global play.

Veriff and Sumsub also made their SPARK Matrix debut in 2025, landing directly in the Leaders quadrant, a testament to how rapid innovation and regulatory adaptability can outpace legacy incumbents.

Final Take: Orchestrated KYC is the New Competitive Edge

The 2025 KYC SPARK Matrix proves that leadership is no longer about who’s been around the longest, it’s about who’s building real-time, orchestrated, risk-aware identity infrastructure.

Platforms like Sumsub, Veriff, and SAS ascended by embracing modularity, perpetual KYC, explainable AI, and case-driven compliance. Others stagnated by focusing solely on data or legacy verification models.

According to Siddharth Arya, Principal Analyst at QKS Group:

“In today’s financial industry, KYC has shifted from a back-office obligation to a front-line priority, as banks and fintechs face mounting regulatory pressures, rising costs, and growing expectations for seamless digital onboarding. It has become a real-time, intelligence-led function, and the distinction between vendors who merely process data and those who operationalize it has become ever more important. The future of KYC lies in orchestrated intelligence, where perpetual risk monitoring, AI explainability, and fraud detection converge to create an adaptive trust framework. The leaders of 2025 aren’t just verifying identities; they’re leveraging AI, machine learning, and end-to-end workflow automation to adapt, orchestrate, and scale intelligence across the customer lifecycle, transforming compliance into a proactive, risk-aware enabler of trust.”

Conclusion: Choosing the Right KYC Vendor in 2025

The SPARK Matrix 2025 doesn’t just highlight top vendors; it reflects the future of digital identity compliance.

Buyers should prioritize platforms that:

- Offer end-to-end KYC orchestration

- Embed fraud detection into onboarding flows

- Support real-time, perpetual monitoring

- Deliver explainable AI for regulatory scrutiny

- Scale across geographies with configurable workflows

In 2025 and beyond, identity verification isn’t just about knowing your customer; it’s about understanding risk, anticipating fraud, and enabling trust on a scale.

Report link: SPARK Matrix™: Know Your Customer (KYC) Solution, Q2 2025