The life and annuity (L&A) insurance industry is at a critical inflection point, moving beyond mere digital transformation toward a more agile, composable, and data-driven operating model. In the last year, the focus has shifted from simply automating legacy processes to enabling rapid product innovation and personalized customer experiences. This evolution has redefined what it means to be a technology leader, pushing vendors to adopt more open, modular architectures and operationalize advanced intelligence.

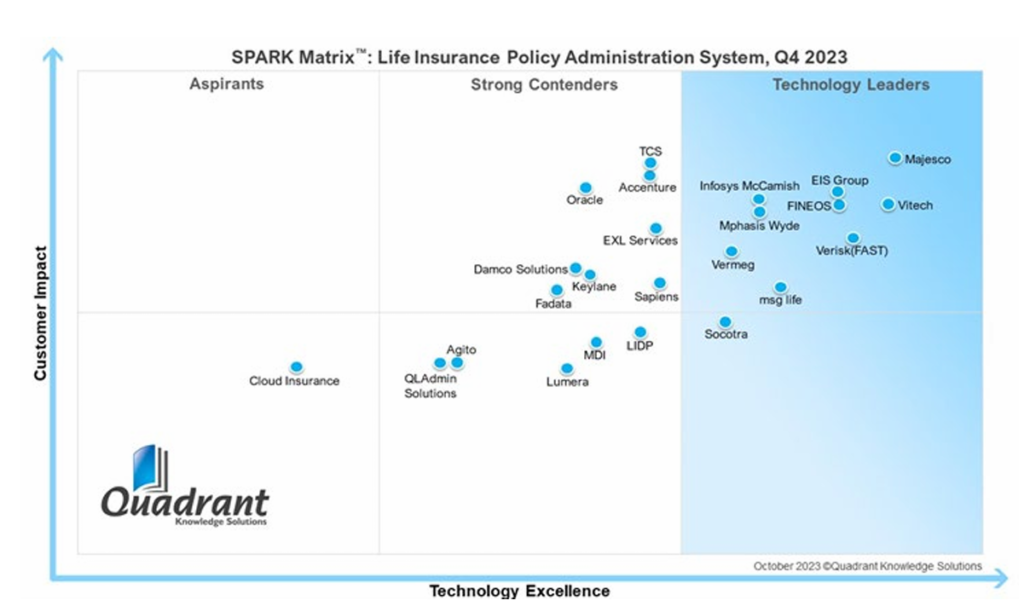

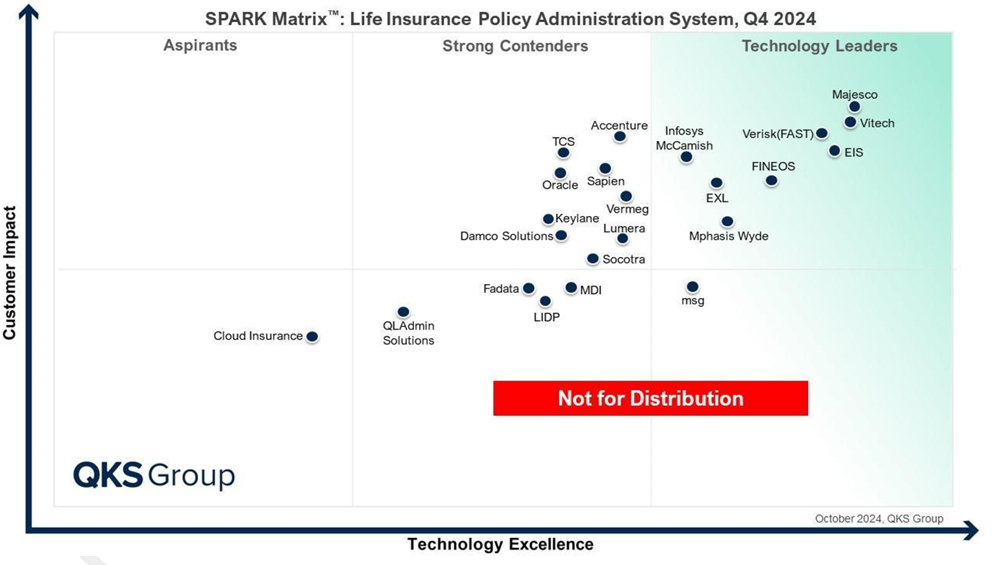

The SPARK Matrix is a strategic performance assessment and ranking of key market participants, measuring them on two core axes:

- Technology Excellence

- Customer Impact

Technology Excellence evaluates the core product capabilities, while Customer Impact assesses factors like market presence, customer experience, and value proposition. The most notable shifts in the 2024 analysis are directly linked to vendors’ ability to deliver composability, operational AI, and seamless orchestration across the entire value chain.

Top Trends in 2024

The Rise of Composable Architecture and Accelerated Time-to-Value

The demand for speed and flexibility is fundamentally reshaping the market. Insurers can no longer afford rigid, monolithic systems that delay new product launches. The 2024 SPARK Matrix shows a clear preference for vendors offering modular, API-first platforms that empower insurers with greater agility. Leading vendors like EIS have leveraged this by building their EIS Suite on a microservice architecture, allowing for individual modules like PolicyCore and ClaimCore to be deployed and integrated as needed. This shift to a composable approach is a direct response to the market’s need to quickly adapt to new opportunities and competitive pressures.

From Static Insights to Operational AI and Real-Time Decisions

AI is no longer a futuristic promise; it has become a core operational capability. In 2024, top-performing policy administration systems are embedding AI and analytics directly into workflows to enhance decision-making and drive straight-through processing (STP). FINEOS, for instance, now offers a cloud-native platform with AI-driven workflows, providing real-time analytics and predictive models that inform data-driven decisions. Similarly, EIS and msg life are using AI to automate underwriting and improve the 360-degree view of the customer journey, demonstrating a move toward proactive, intelligent systems that can forecast trends and detect fraud. This is a material shift from the 2023 focus on general analytics to a 2024 focus on operationalized intelligence.

Low-Code/No-Code as a Foundational Capability

To truly achieve agility, insurers must be able to design and deploy products without extensive IT intervention. The 2024 SPARK Matrix highlights that low-code and no-code tools are now table stakes for leaders. Majesco, a consistent leader, enhanced its platform with the Digital1st Platform, a key tool for low-code/no-code application development that helps create personalized engagement for agents and customers. Verisk’s FAST platform also emphasizes a “toolkit” for rapid product design and configurable workflows, thus enabling insurers to quickly adapt to market demands. This capability directly enables a faster time-to-market and allows business teams to own the innovation cycle.

The Convergence of Life, Health, and Wealth Services

The market is seeing a blurring of lines between product types as insurers seek a more holistic view of the customer. The 2024 report explicitly notes this trend, with platforms moving toward a more integrated ecosystem that supports life, health, and wealth services. The emergence of EXL as a top performer in 2024 is a testament to this trend. Their LifePRO™ Digital Insurance Platform supports life, health, and annuity products on a single platform, enhancing operational efficiency through automation and digital servicing across the entire spectrum of customer needs.

Vendor Position Analysis

The Leaders: Staying on Top Through Innovation

Majesco is maintaining its position as a top leader. Majesco continues to differentiate with its cloud-native L&AH Intelligent Core Suite. The vendor’s key challenge will be scaling its low-code and AI offerings to serve the most complex, global insurers while maintaining a consistent pace of innovation.

Vitech’s V3locity platform continues to be a top performer by providing a centralized repository for policy data, enabling real-time decisioning and straight-through processing. The platform’s strength lies in its robust core. But it will need to ensure its native workflow and CRM capabilities remain cutting-edge to compete with specialized point solutions. The Verisk FAST platform retains its leader position through a holistic suite of solutions. It allows users to span the product and customer lifecycle. Its challenge is to continue integrating advanced tools, such as the Life Risk Navigator, into a user-friendly platform. Now, that is easy for non-technical users to configure and manage.

EIS, leader in both years, EIS’s API-first, microservice architecture is a key differentiator, providing the agility required by modern insurers. It can leverage AI and analytics to automate core functions like underwriting and enhance decision-making across the board. EXL is ascending to the leader quadrant in 2024. EXL’s LifePRO™ platform is a notable success story. The platform’s ability to support life, health, and annuity products from a unified system, combined with AI-powered solutions like XTRAKTO.AI™, has driven this movement. EXL’s primary challenge will be to sustain this momentum and continue to integrate advanced analytics and automation. Other Leaders, such as Mphasis Wyde and MSG, are holding on to their place in the leader quadrant even though there are movements within.

Maintaining Position and Gaining Traction

Socotra and Vermeg, previously listed as top performers in 2023, are now positioned as strong contenders in 2024. While their platforms remain robust, other vendors have moved faster to embrace key trends. These trends include operational AI and low-code configurability, which are now critical for leadership status. Socotra and Vermeg must demonstrate their ability to integrate these capabilities more deeply to regain ground.

Accenture, TCS, Sapiens, and Oracle: These vendors are consistently positioned as strong contenders. That may be due to their comprehensive technological capabilities and rapid market traction. Their strength lies in their ability to serve large, complex organizations with a strong roadmap for future growth. The challenge for these players will be to accelerate their time-to-value for customers and demonstrate the full impact of their solutions. Keylane, Lumera, Damco, MDI, Fadata, LIDP, and QLAdmin Solution have maintained their positions in the contender’s quadrant. Cloud Insurance remained in the Aspirant position in both years without any visible movements.

What Is the Takeaway?

The path forward for life and annuity insurers is clear: prioritize platforms that offer agility and intelligence. Look for solutions with a modular, API-first architecture that allows for a composable technology stack. Insist on platforms that operationalize AI to drive straight-through processing and deliver real-time insights, rather than relying on static dashboards. Finally, choose a vendor with a strong partner ecosystem and robust low-code tools. That will enable your business teams to take control of product innovation and customer experience.

To thrive in the coming year, policy administration system vendors must continue to embed AI and MI into every function. The next frontier is to move beyond simple automation to true orchestration, using AI to manage the entire policy lifecycle seamlessly. Furthermore, vendors must double down on their low-code/no-code offerings, empowering insurers to rapidly create and modify products without technical debt. The market will favor those who can modernize the core and accelerate the business outcomes of their clients.

According to Varun Singh Bisht, Analyst, QKS Group:

“The fusion of composable architectures and operational AI is transforming life insurance policy administration, enabling insurers to shift from rigid automation to agile, customer-centric innovation. As market demands intensify, vendors must leverage modular platforms, low-code/no-code tools, and real-time analytics to orchestrate seamless policy lifecycles. This empowers insurers to accelerate product delivery and enhance customer trust, staying ahead in a dynamic and competitive landscape.”

Conclusion

The 2024 SPARK Matrix for Life Insurance Policy Administration Systems shows a market in a state of evolution. Leadership is no longer defined by a comprehensive feature set alone, but by a platform’s ability to deliver operational agility, embedded intelligence, and accelerated time-to-value. The new era of leadership belongs to those who empower insurers to not only manage policies but to orchestrate their entire business and customer ecosystem.