In an era where every trade can trigger a ripple across global markets, Trade Surveillance & Monitoring has become a core pillar of financial integrity. What was once a regulatory formality has now matured into a strategic enabler, one that can define a firm’s agility, foresight, and trustworthiness. And as compliance challenges grow more complex, so too does the urgency to adopt platforms that are not just reactive but predictive.

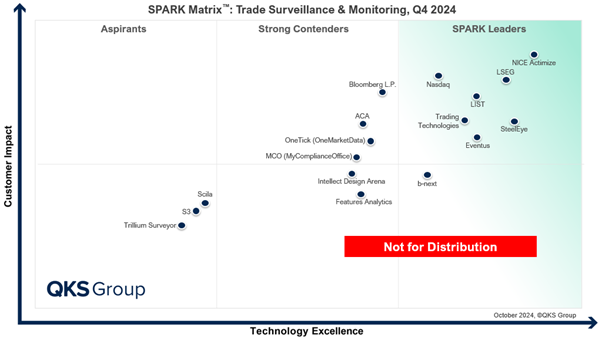

The SPARK Matrix™ comparison between 2023 and 2024 reveals a market in flux, vendors doubling down on AI, expanding asset class coverage, and reimagining user interfaces for faster, smarter, and more accurate oversight. In this world, standing still is the fastest way to fall behind.

The Consistent: Leadership Through Intelligence

Some vendors didn’t just keep pace with the evolving market; they helped shape its trajectory. NICE Actimize continues to lead the market across both years, sitting confidently at the top. Its hallmark? A sophisticated blend of advanced AI-driven analytics, surveillance and holistic risk coverage, Actimize remains the vendor to beat.

LSEG (London Stock Exchange Group) and LIST have maintained their strong leadership position by delivering powerful platforms with expansive trade coverage and analytics-driven insights. Their platforms are prized for scalability and multi-venue monitoring, qualities increasingly in demand as trading activity sprawls across geographies and instruments.

SteelEye and Eventus have held their ground firmly. SteelEye offers a fully integrated, cloud-native platform that simplifies trade and communications surveillance. It emphasizes data consolidation, configurability, and automation, helping firms meet regulatory obligations efficiently while giving compliance teams greater control and insight. And Eventus, through its Validus platform, provides customizable, data-agnostic surveillance with advanced visualization and investigative tools. It supports near real-time and T+1 monitoring, and its automation features help reduce false positive, making it ideal for fragmented, high-volume environments

Then there’s Nasdaq. It is still one of the most trusted names in surveillance. Its market monitoring platform continues to evolve, integrating real-time alerting and cloud adaptability. While its global brand and technical pedigree offer natural advantages, Nasdaq’s next leap could come from deeper AI adoption and broader coverage into alternative and digital asset classes.

The Risers: New Entrants, Bigger Impact

Among the most notable moves in 2024 is the rise of Trading Technologies. Absent from the leadership zones in 2023, the vendor made a decisive entry into the leader quadrant this year. Its focus on integrating trade surveillance directly into execution workflows is particularly appealing to firms seeking holistic risk oversight. its clearly paying off.

The Drop-offs: Fading from the Frontlines

Some vendors have lost ground between the 2023 and 2024 Matrix. SymphonyAI, NetReveal, Altair, and Quantexa, who were seen as strong contenders in 2023, have seemed to have faded in the 2024 landscape. Whether due to shifting product strategies, limited innovation, or heightened competition, their diminished presence is notable.

b-next’s slip from a leader quadrant in 2023 to a lower position in 2024. This highlights a key challenge: maintaining velocity. In a market where regulatory change is constant, platforms must evolve just as rapidly. Innovation inertia can quickly erode customer trust and market influence. Similarly, Intellect Design Arena and Features Analytics continue to stay as contenders but show little to no advancement, highlighting a possible stagnation in technology or market traction.

The Still-Waiting: Aspirations vs. Adoption

Vendors like S3, Scila, and Trillium Surveyor remains in the Aspirant zone of the Matrix. Although they had some gains in technology maturity, they have not yet delivered significance in customer impact. Their platforms may offer value in niche segments, but scaling to broader enterprise use cases will require sharper differentiation and stronger go-to-market alignment.

Conclusion

The Trade Surveillance & Monitoring market is evolving rapidly. In an environment where regulatory scrutiny is only intensifying, vendors can no longer afford to stay stagnant. Leaders like NICE Actimize, LSEG, LIST, and SteelEye have set the gold standard with scalable, agile, and predictive solutions. Emerging players like Trading Technologies prove that there’s always room at the top for those willing to innovate. For vendors lagging, the message is clear: invest in AI-driven analytics, focus on user-centric upgrades, and ensure seamless integration capabilities. For end-users, it’s an exciting time; you have more intelligent, customizable, and powerful options than ever before. Choose wisely, because in today’s world, effective surveillance isn’t just a tool; it’s your competitive shield.