Understanding the Shift in Integrated Payments

Integrated Payment Platforms have evolved far beyond mere transaction processors. In 2025, they represent the operational backbone of digital commerce and banking ecosystems, unifying payment initiation, authorization, settlement, fraud prevention, reporting, and orchestration under a single, scalable infrastructure. Their scope extends across real-time payments (RTP), SWIFT, SEPA, ISO 20022 compliance, card processing, tokenization, and even embedded finance rails, all through composable APIs and low-code interfaces.

What makes an integrated payment platform truly “integrated” today? It’s no longer coverage of payment types, but the ability to orchestrate them across diverse geographies, regulatory environments, and customer experiences.

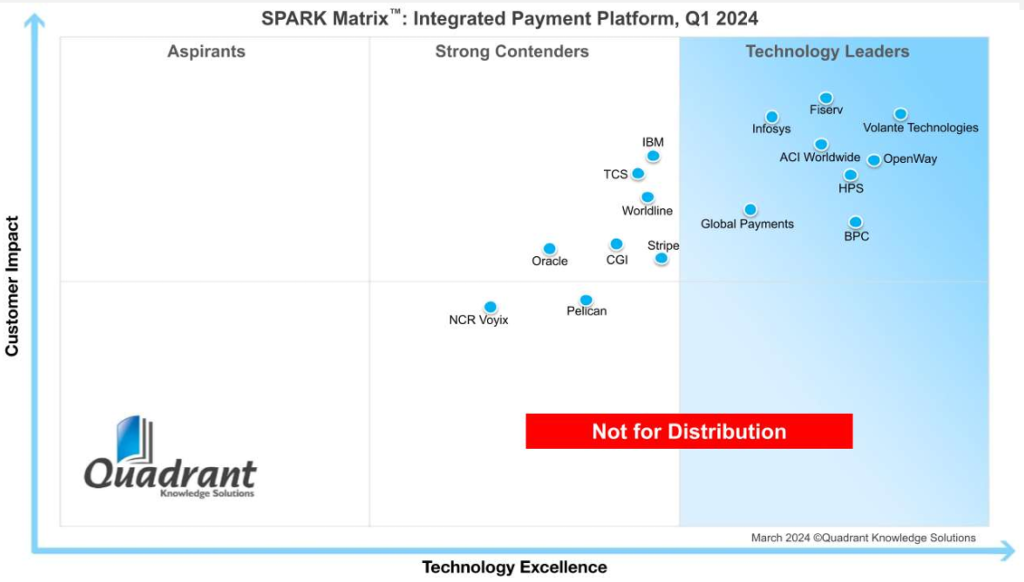

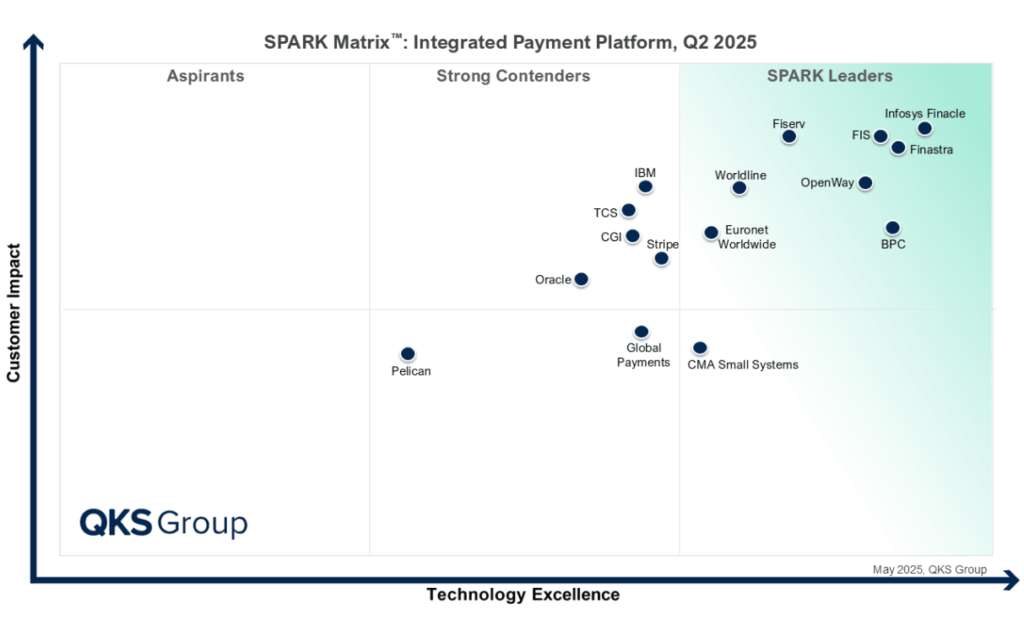

According to the QKS Group’s 2025 SPARK Matrix™, the market for Integrated Payment Platforms has witnessed a tangible shift. From vendor differentiation on rail compatibility to competitive positioning around cloud-native composability, AI-driven fraud detection, embedded analytics, and ecosystem extensibility. The market matured substantially between 2024 and 2025. This change rewarded those who built for orchestration and penalized those still delivering linear, siloed payment workflows.

The SPARK Matrix™, developed by QKS Group, is an evaluation tool used to benchmark vendors across two dimensions:

- Technology Excellence

- Customer Impact

Each edition is based on primary briefings, customer references, product capability analysis, and market sentiment mapping. This blog compares the 2024 and 2025 SPARK reports of the Integrated Payment Platform to unpack which vendors sustained leadership. It also compares which vendor emerged and which lost strategic ground, giving enterprise buyers clarity on what’s shifting.

The Industry’s New Center of Gravity

The leaders of 2025 reflect a strategic shift. While 2024 rewarded breadth of features and real-time capability, 2025 recognized those vendors who matured into intelligent payment orchestrators. These vendors weren’t just fast, they were flexible. They invested in open architectures, native AI engines for fraud detection and reconciliation, and composable frameworks that let banks and fintech’s tailor payment experiences by region, instrument, or workflow.

Infosys Finacle, OpenWay, Fiserv, and BPC remained among the consistent Leaders. Their platforms delivered continuity across 2024 and 2025 because they understood that payments are no longer a back-end utility; they are the interface of trust, speed, and revenue.

Infosys Finacle stood out with its containerized deployments, embedded blockchain processing, and advanced overlay services. OpenWay’s Way4 platform enabled full-spectrum issuing and acquiring, from tokenized card products to crypto wallets, allowing banks and fintechs to launch innovative services without disrupting core operations.

Fiserv solidified its leadership with enterprise-grade reliability and an API-first payment orchestration layer that served both legacy and cloud-native use cases. Meanwhile, BPC’s SmartVista platform remained ahead in offering an end-to-end embedded finance backbone for banks operating in high-growth markets, especially where public sector digitization, transport systems, and multi-factor fraud protocols intersect.

But what marked 2025 was the bold rise of new Leaders. Finastra, FIS, Worldline, and Euronet Worldwide joined the top-right quadrant, none of them placed there in 2024. Their ascension was not superficial.

Finastra and FIS rebuilt their infrastructure to support ISO 20022 harmonization, broader SWIFT gateway compatibility, and stronger business-rule orchestration for high-value and corporate payments. Worldline, notably, sharpened its omnichannel proposition with its own proprietary terminal ecosystem and SME-focused payment stack, giving it momentum in both developed and emerging economies. Euronet’s rise was powered by its robust ATM connectivity, domestic switching systems, and a growing orchestration suite focused on remittances and real-time corridors.

This expansion at the top reflects the market’s hunger for platforms that can unify payment, compliance, analytics, and onboarding, not just as modules but as interoperable flows.

Midfield Contenders: Still Relevant, But Not Breaking Through

Several well-known vendors held their ground in the Contender zone across both years, but their growth was incremental. IBM, TCS, CGI, Oracle, and Stripe maintained their presence but did not break into the Leader zone. This suggests that they are either not evolving fast enough in orchestration or not addressing customer-specific workflows with enough flexibility.

IBM’s payment platforms continue to emphasize stability and resiliency, but customer references suggest a lack of orchestration agility. TCS BaNCS, widely deployed, hasn’t translated that presence into platform modernization at the same pace as newer entrants. CGI offers solid liquidity monitoring and cash flow tools but lacks AI-enabled orchestration maturity.

Oracle remains heavily invested in core audit, controls, and ledger integration, but hasn’t yet transitioned into embedded, API-led ecosystems. Stripe, though strong in developer experience and subscription billing, remains more suitable for mid-market firms than enterprise-scale financial institutions.

These platforms are respected, but without deeper modularity, composability, or intelligence layers, they remain safe choices rather than transformative partners.

Who Fell Behind and Why: The Cost of Strategic Stagnation

2025 also marked a sobering reshuffle for some vendors who had earned high positions in the previous year. Global Payments, a 2024 Leader, slid to the lower quadrant in 2025. Despite a strong foundation built around its real-time engine and security layers, the platform fell behind in orchestrated experiences, low-code workflow extensions, and modular dashboards for payment intelligence. The market’s expectations outpaced its roadmap.

Pelican, known for its AI-first positioning, also dropped, despite continuing to support advanced NLP and payment screening. Its limited expansion in embedded fraud analytics and dashboard flexibility may have contributed to its lower 2025 ranking.

More strikingly, some 2024 Leaders were absent from the 2025 matrix altogether. Some vendors were previously recognized for their real-time engines and agile configuration tools, were not featured in the 2025 report. While the reasons could range from non-participation to M&A activity or regional focus shifts, their absence opens space for new entrants and narrows the field of top-tier orchestrators.

Newcomers to Watch: Quiet Entry, Strong Signal

Among the interesting additions in 2025 was CMA Small System, which entered the Lower Leader quadrant. Likely catering to regional or niche markets, its strength appears to lie in rapid time-to-value, compliance-ready workflows, and highly localized payment processing infrastructure.

While it may not compete head-to-head with global giants, its presence underscores a rising trend, regional platforms with deep contextual expertise are increasingly influencing buyer decisions, especially in regulated economies with unique payment constructs.

Industry Takeaway: Payments Are Now Product Strategy

The comparison between the 2024 and 2025 SPARK Matrix editions makes one thing very clear. The market is no longer just buying payment systems; it’s buying platforms that enable real-time, intelligent, and modular payment experiences.

What separated Leaders from Contenders this year was not the number of supported rails or channels, but:

- How seamlessly those rails are orchestrated end-to-end

- How quickly can platforms be configured for new geographies, regulations, or customer journeys

- How deeply payment flows are integrated with fraud, compliance, reporting, and personalization layers

In short, orchestration now defines competitiveness.

Final Thoughts: From Commodity to Catalyst

Integrated Payment Platforms have crossed a threshold. From being commoditized processing utilities, they have emerged as strategic enablers of embedded finance, open banking, and real-time global commerce. The SPARK Matrix™ 2025 report confirms this shift, and enterprise buyers would do well to calibrate their selection criteria accordingly.

Choose platforms that offer more than rail compatibility, demand orchestration, and composability. Prefer vendors that enable real-time analytics and modular integration over static, siloed solutions. Most of all, partner with providers who treat payments not as plumbing, but as a product, a revenue engine, and a customer experience differentiator.

Because in 2025, integrated payments aren’t just about what you move, they’re about how you orchestrate the movement.

As Pradnya Gugale, Principal Analyst at QKS Group, states,

“The Integrated Payment Platform market is undergoing a foundational shift as financial institutions prioritize real-time processing, ISO 20022 adoption, and API-driven orchestration to modernize their payment infrastructure. Vendors are increasingly offering modular, cloud-native platforms that unify domestic and cross-border payments, support emerging rails like RTP and FedNow, and embed AI for fraud detection, compliance, and analytics. The 2025 SPARK Matrix reflects a market increasingly defined by interoperability, scalability, and intelligent automation, positioning integrated platforms as critical enablers of next-generation payment ecosystems.”

Full report: SPARK Matrix™: Integrated Payment Platform, Q2 2025